It appears that evidently folks nonetheless affiliate blockchain primarily with BitCoin and different cryptocurrencies, whereas the potential of this expertise goes far past that. Now we have already written concerning the alternatives it brings to logistics, healthcare, playing, and the general public sector. On this weblog publish, we wish to discuss the benefits of blockchain in banking.

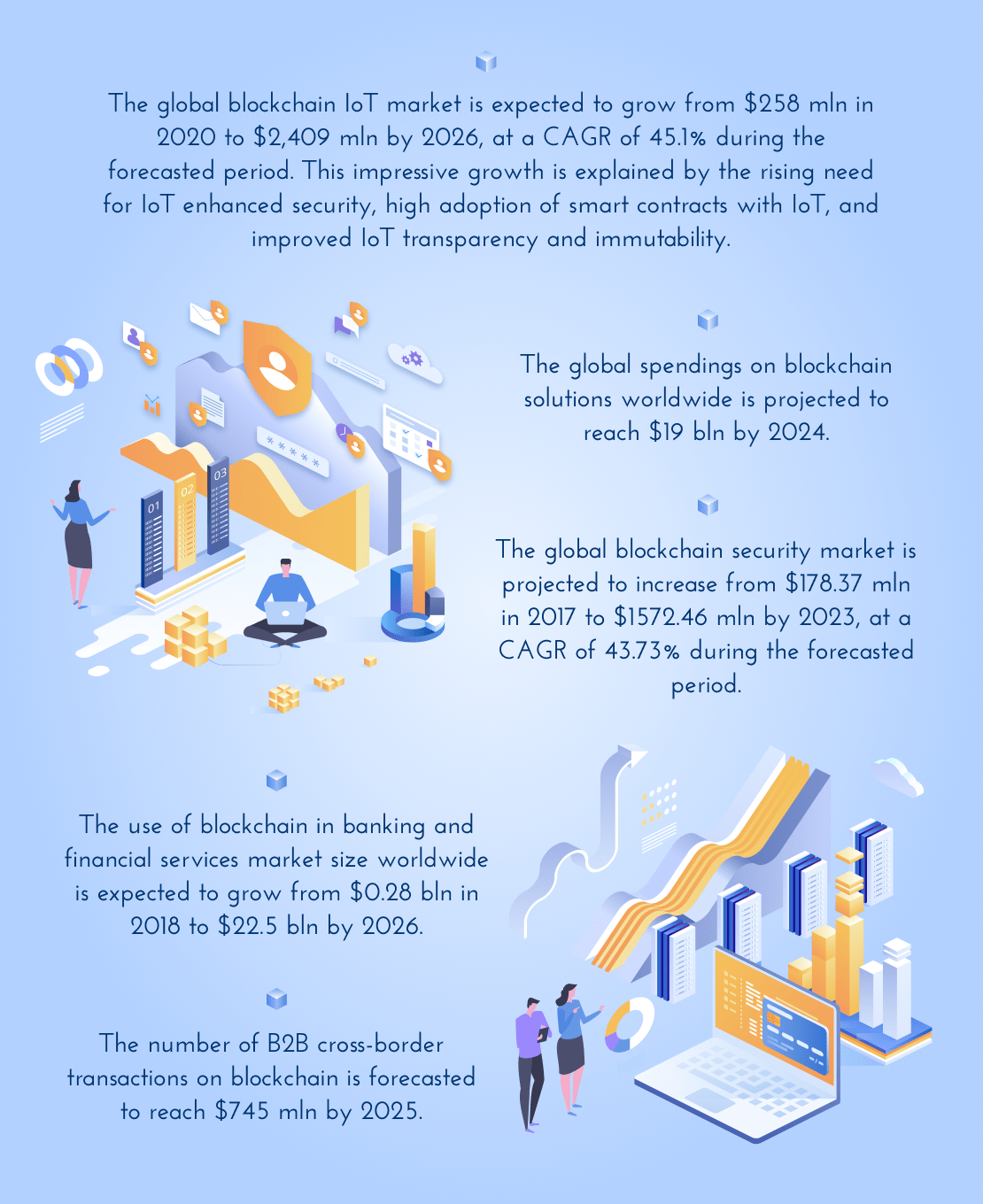

Blockchain in Varied Industries – Key Stats

What Is Blockchain in Banking?

Blockchain is a distributed ledger expertise that holds encrypted blocks of information with all of the digital transactions carried out by blockchain customers. When blockchain is used as a enterprise community, it permits its members to file their transactions and observe them within the system. The recorded transactions can’t be faraway from the block or modified. This fashion, blockchain helps its customers to make banking processes safer, dependable, clear, and environment friendly.

This expertise enhances knowledge safety, making it immutable and straightforward to confirm. It could actually drive knowledge safety throughout numerous industries to a model new stage, eliminating fraud and errors. For the reason that banking business suffers probably the most from scammer assaults, implementing blockchain in monetary providers might save the day. Listed below are the core execs of blockchain in banking:

Safety

Use of blockchain in banking permits companies to cowl a variety of safety points. The expertise might be carried out at totally different ranges from defending delicate information to enhanced person authentication. Right here is how blockchain can enhance safety in digital banking techniques:

- Person authentication – blockchain eliminates the need to guard person and financial institution accounts and units with passwords. As an alternative, the expertise combines blockchain safety with biometrics, encrypting customers’ distinctive identifiers e.g. iris scans, fingerprints, voice, and many others. right into a block in blockchain. The expertise makes use of the encrypted block with person identifiers as an entry key to apps and devices or as a key to signal the info the person sends to others.

- Information safety – as a result of decentralized nature of blockchain, cyber criminals need to work with a whole blockchain system fairly than a central node to hack it. For the reason that knowledge is unfold throughout a number of nodes, there is no such thing as a specific server or one other place to assault. For that reason, some banking establishments use blockchain for knowledge storage and securing transactions.

- Safe communication – blockchain can be utilized for securing inner communication, stopping any knowledge leakages or cyber espionage. The expertise spreads the metadata utilized for communications across the distributed ledger, making it unimaginable for hackers to gather it at one centralized level.

Pace

Immediately, many banking operations and monetary transactions are fairly gradual and might take a lot time for his or her administration, approval, and logging, furthermore, some actions are nonetheless carried out manually. Fintech blockchain simply solves that concern permitting instantaneous authentication and verification which helps to streamline banking processes e.g. performing fast cross-border funds, finance buying and selling, KYC verification, and many others., and cut back paperwork.

What’s extra, with a unified blockchain-based platform throughout banking establishments, banks can present an uninterrupted operation of finance providers. Due to this fact, making their work extra environment friendly and bettering their clients’ digital banking experiences.

Transparency

Blockchain expertise in banking will increase transaction transparency, making it simple to detect and stop fraud. As banks use a shared digital ledger for recording every transaction, it will increase their visibility for the blockchain members. Due to this fact, banks can simply observe the historical past of every transaction and confirm it. This fashion, blockchain banking leaves no place for cash laundering, rip-off, and different faux operations.

Decentralization

One other excellent blockchain function essential for the monetary sphere is decentralization. Decentralization results in a extra democratic relationship out there between people and establishments. As an alternative of counting on a government that controls each transaction, consumers and sellers can immediately talk with one another. This leads to decrease operational prices, elevated belief between transactors, and the shortcoming of people or separate organizations to manage the market.

For instance, worldwide funds in decentralized digital currencies are cheaper compared to transnational fiat funds as they get rid of any financial institution charges and don’t conform to any financial institution insurance policies. Furthermore, decentralized currencies are extra immune to destabilized forex charges as they aren’t regulated by any nationwide financial insurance policies, representing a extra secure various.

Good Сontracts

Good contracts are blockchain packages that self-execute as soon as sure situations are met. This blockchain expertise can facilitate many processes in banks and monetary establishments. Right here is how banks can use sensible contracts of their work:

- automate insurance coverage claims – sensible contracts can mechanically validate the claims indicated within the contracts and execute them as soon as all or sure necessities are met;

- cut back operational prices – as sensible contracts are self-regulatory they don’t require a lot guide intervention, consequently, monetary establishments can decrease their transaction prices in the long run;

- automate cash transfers – with sensible contracts monetary establishments can course of funds and switch funds in real-time;

- carry out easy auditing – conventional contracts require guide processing, which means further workforce and prolonged audit course of; sensible contracts, of their flip, assist numerous bookkeeping instruments which facilitate contract processing.

With blockchain-based sensible contracts, banking and monetary establishments can considerably cut back the extent of paperwork, guarantee belief between companions, speed up processes in addition to lower the necessity for third-party intermediaries.

Blockchain in Finance: Use Circumstances

Now allow us to check out extra particular instances of how blockchain can change the banking and finance business.

Improved KYC

KYC (Know Your Buyer) is a process of identification verification carried out by banks every time they get a brand new buyer. Immediately it’d take over a month as there’s a want for getting evaluations and approvals from third-party organizations and different banking establishments. Annually banks spend as much as $ 160 million on KYC compliance.

The implementation of fintech blockchain is an efficient resolution that accelerates the verification course of, eliminates errors and duplications, prevents a number of interactions with a variety of establishments in addition to permits avoiding fraud and forgery. As soon as verified, the info will likely be securely saved inside the system and simply supplied to different banks (strictly in case of necessity).

Direct Funds and Lendings

On the similar time, blockchain monetary providers permit peer-to-peer or company-to-company direct funds with out banks and processing facilities as intermediaries. The transactions get sooner and cheaper, blockchain additionally ensures traceability and transparency — this brings the world to the idea of DeFi (Decentralized Finance). The concept of DeFi is that everybody throughout the globe can simply take part in a brand new monetary ecosystem that enables peer-to-peer lending and funds, avoiding the need to make use of the providers of banks, lending corporations, and different establishments. So, together with the advantages, blockchain additionally has some dangers for banks and should trigger the necessity for modifications of their processes.

World Commerce Finance

Being carried out into the monetary system, blockchain can considerably enhance and optimize world commerce processes and provide chain administration. With the assistance of sensible contracts and blockchain-based IoT options, the businesses concerned within the worldwide buying and selling community can successfully regulate mutual monetary liabilities, confirm the standard of products, belief one another extra, make all the mandatory funds — and all of those would require much less time, cash, and energy.

Clearance and Settlements Methods

Blockchain distributed ledger expertise can facilitate and velocity up financial institution transfers. A traditional financial institution switch from one a part of the world to a different can take as much as 3 days. This occurs because the switch has to cross a complicated system of intermediaries comprising correspondent banks and custodial providers. The banks that carry out the sending and receiving switch procedures, of their flip, need to align with the worldwide monetary system that features numerous merchants, asset managers, funds, and rather more.

Blockchain expertise in banking can take away the need to reconcile every transaction throughout many monetary establishments’ ledgers. As an alternative, every monetary establishment has entry to the identical distributed ledger with registered transactions. This fashion, every transaction is public, clear, and unified to every participant in the whole community of custodial providers and correspondent banks.

Fundraising

Conventional fundraising by way of enterprise capital generally is a fairly difficult and time-consuming course of. Corporations need to work on two fronts – looking for outdoors buyers and dealing on their product improvement. Blockchain ICOs disrupt typical fundraising ideas permitting corporations to boost funds a lot sooner and in a shorter-circuit course of.

Corporations create their very own preliminary coin choices (ICOs) which they promote to the general public by way of well-known cryptocurrency platforms like Ethereum or BitCoin. This fashion, they’ll shortly increase the mandatory funds even earlier than launching their product to the market.

Being a brand new fundraising technique, ICOs are at the moment barely regulated. However, many companies see the potential of ICOs and experiment with them. David Pakman, a former accomplice at Venrock, who’s at the moment working at crypto VC agency CoinFund says that crypto “appears to be the most important and most fascinating alternative for long run enterprise funding, wealth creation, and disruption.”

Backside Line

On this weblog publish, we have now highlighted solely a few examples of how blockchain is altering the banking and finance sector. The processes get less complicated, sooner, and safer, placing the business into new situations, and convey up new alternatives in addition to challenges.

Having a large number of skilled blockchain builders, SCAND empowers the business gamers with sturdy and dependable software program options. When you have an concept that includes blockchain expertise, contact us to make it a actuality!