Disclaimer: Except in any other case said any opinions expressed under belong solely to the creator. Information comes from third occasion analysis.

Over the previous three years, world inflation has shaken shopper confidence around the globe, placing strain on thousands and thousands of individuals going through uncertainty because of costs of on a regular basis items and companies seemingly spinning uncontrolled.

Singaporeans weren’t spared the calamity, in fact. Though the speed of inflation is presently again all the way down to very low ranges of beneath 1%, that doesn’t imply that costs have fallen. They merely stopped rising.

The query on this scenario is: how rapidly have earnings and disposable incomes within the financial system grown to make these larger costs reasonably priced once more?

Because it seems, within the case of Singapore, very.

Glad like a Singaporean

Within the annual Metropolis Pulse 2025 report by the Gensler Analysis Institute, 59% of Singaporeans said that it was unlikely or most unlikely for them to go away the town for greener pastures—the third highest share on the earth, behind Taipei (64%) and Ho Chi Minh Metropolis (61%).

77% of Singaporeans are happy with their house and, most significantly in our context, round half say that the affordability of life within the metropolis has improved over the previous yr.

This echoes the findings of a extra strong and ongoing home survey of sociopolitical sentiments in Singapore, carried out by Blackbox Analysis.

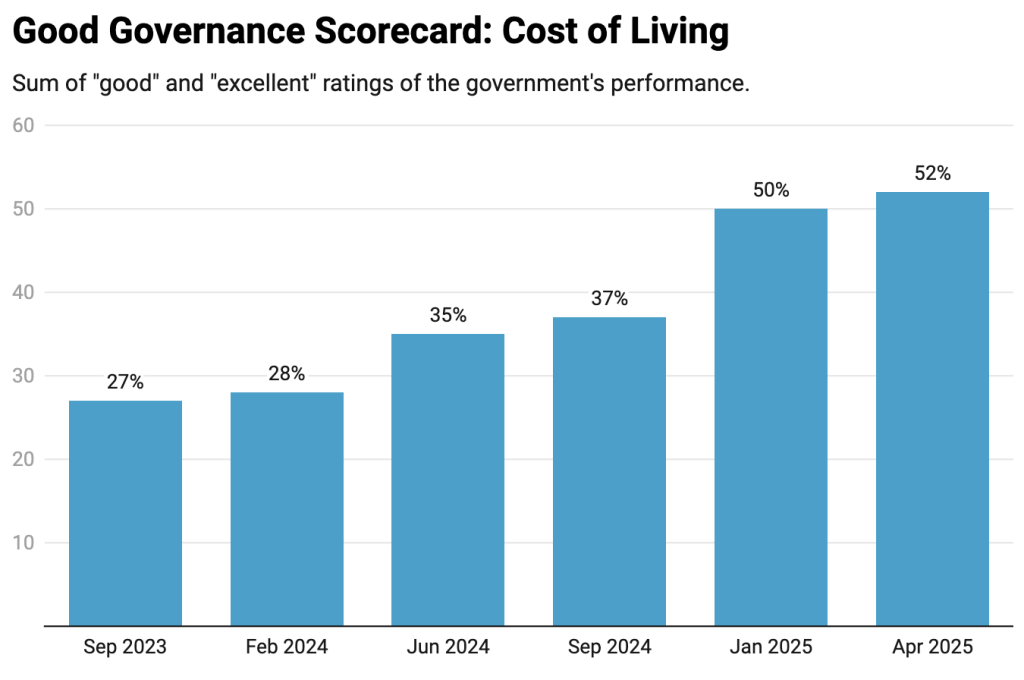

Much like Gensler Institute’s outcomes, it reveals that 52% of Singaporeans approve of the federal government’s dealing with of the price of dwelling disaster—up from simply 27% in September of 2023.

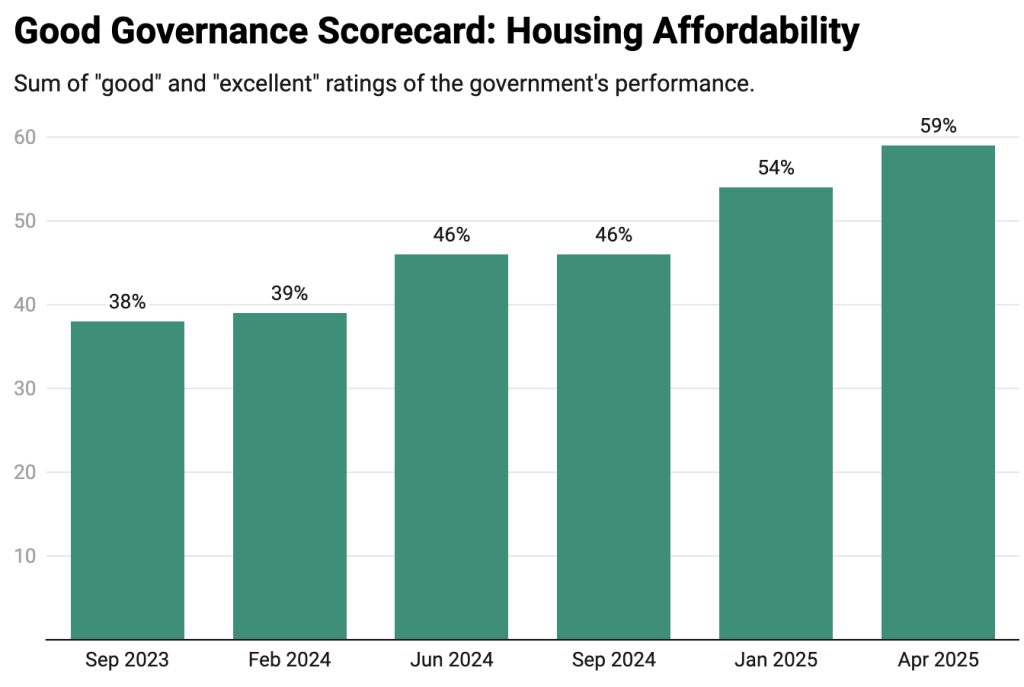

Much more Singaporeans are happy with how the rising housing prices have been addressed, with near 60% pleased with the federal government’s efficiency in 2025, up from beneath 40% lower than two years in the past.

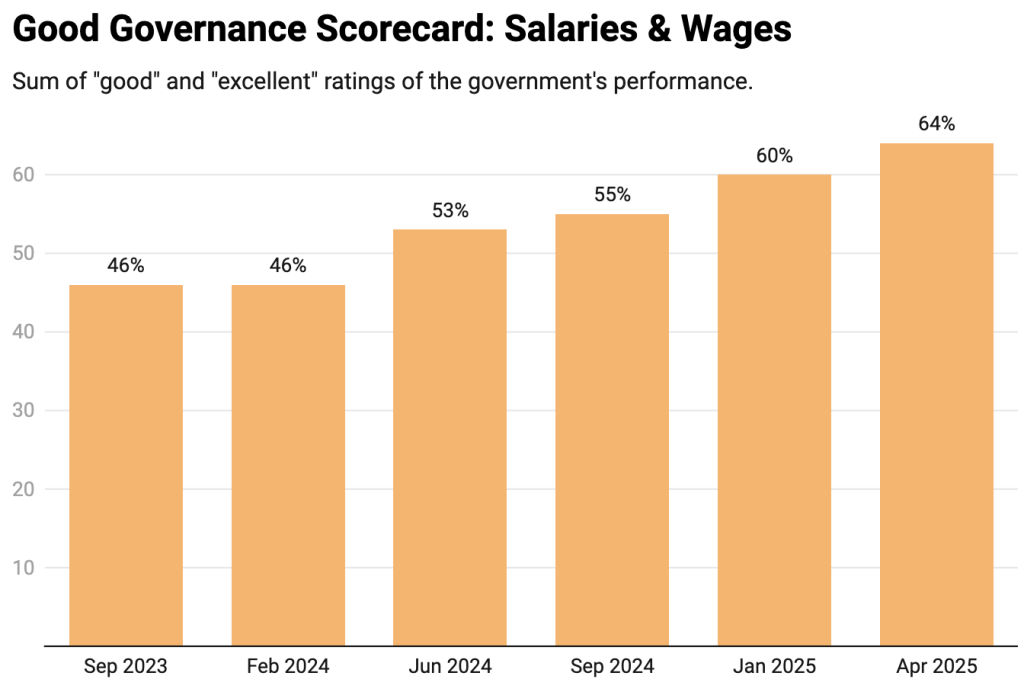

These numbers are larger nonetheless for the present state of native salaries and wages, as virtually two-thirds of respondents are lastly pleased with the scenario.

As you’ll be able to see, the pressures of dwelling prices have eased considerably over the previous two years, with Singaporeans expressing happiness with the federal government’s dealing with of the largely world issues that made their lives uneasy and troublesome.

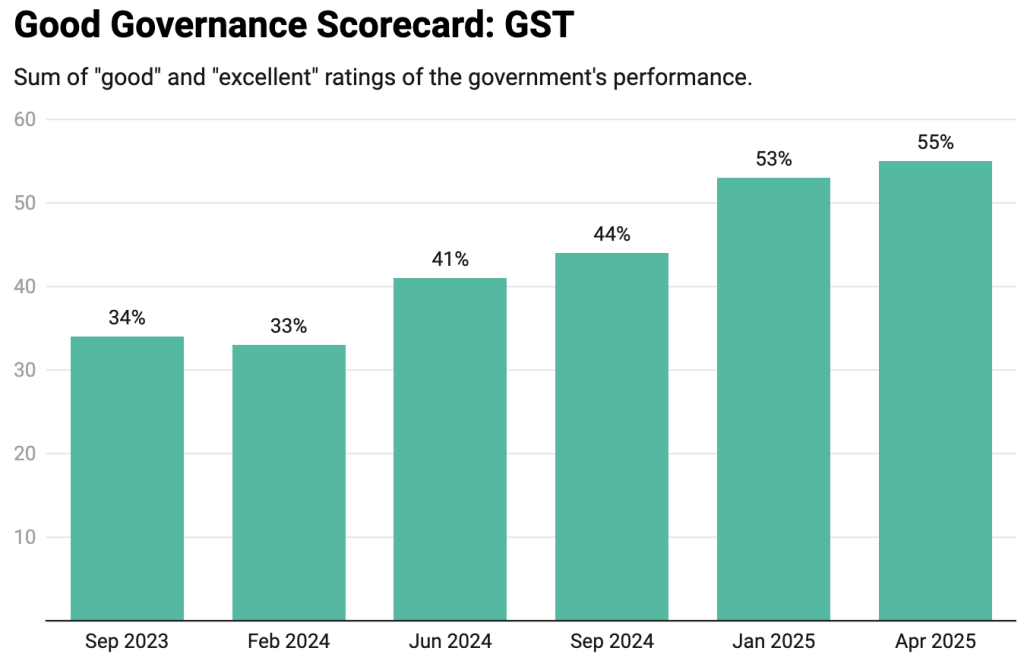

That is regardless of the controversial and unpopular hike of the Items & Companies Tax.

Not even GST is an issue anymore

The contentious GST will increase, executed in 2023 and 2024, have been initially met with adverse responses, however as time has passed by, with the federal government saying new measures to ease the ache on common customers, Singaporeans have grown to just accept the brand new actuality.

From simply one-third just a little over a yr in the past, greater than half of the society now approves of how the GST will increase have been dealt with, following beneficiant reduction packages handed out by the federal government whereas sustaining budgetary surpluses.

In whole, over 79% of respondents are happy with their monetary scenario, and a whopping 84% have rated financial situations positively this April.

What’s extra, 56% of Singaporeans anticipate to be higher off financially this time subsequent yr, whereas simply 15% suppose in any other case.

All in all, sentiments within the society have acquired an enormous enhance up to now 20 months—shifting from deep uncertainty brought on by rampant inflation, to satisfaction and optimism wanting forward in the direction of 2026.

Whereas the price of dwelling stays an important problem for about 40% of the society, that determine is down from practically 60% in late 2023, indicating {that a} majority of Singaporeans really feel they’re lastly within the clear on the subject of monetary woes.

- Learn different articles we’ve written on Singapore’s present affairs right here.