Snap Inc., the guardian firm of Snapchat, has revealed its newest efficiency replace, displaying improved income efficiency, and a gentle enhance in customers, as it really works to get its enterprise parts again heading in the right direction.

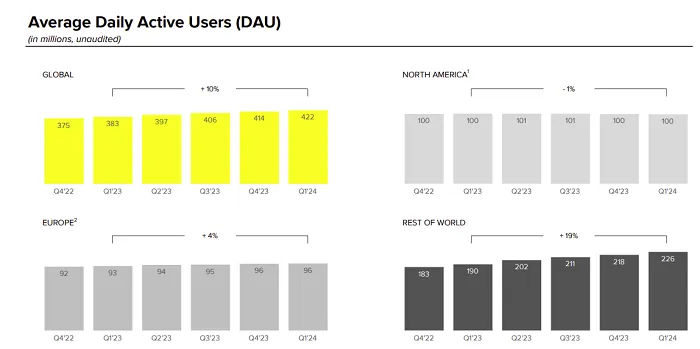

First off, by way of customers. Snapchat is now as much as 422 each day actives, a rise of 8 million customers on the earlier interval.

Which is nice, however the worrying signal for Snap is that it’s nonetheless not gaining traction in its key income markets, with U.S. and EU utilization remaining flat within the interval.

Gaining extra customers in rising markets is essential for future development prospects, as extra customers equals extra alternative. However on the similar time, these areas don’t at the moment usher in anyplace close to as a lot income for the app.

As you may see in these charts, Snap brings in far more revenue from its U.S. viewers, and virtually double the A.R.P.U. from European customers because the “Remainder of the World” class.

That’s why in its final replace, Snap famous that it might be placing extra give attention to rising its U.S. and EU audiences, versus different areas, however up to now, that hasn’t had an affect, not less than on person development.

When it comes to particular behaviors, Snap says that total time spent watching its TikTok-like Highlight video feed elevated greater than 125% year-over-year. That underlines the importance of TikTok’s affect on the broader social media panorama, and why some consider that Snap is poised to take a leap, if TikTok does ultimately find yourself exiting the U.S.

Again in 2020, when TikTok was banned in India, Snapchat was certainly an enormous winner, with app downloads successfully doubling within the area. Although it’s a a lot completely different state of affairs within the U.S., and that was additionally earlier than the arrival of Instagram Reels and YouTube Shorts, so it’s unlikely to see the identical kind of bump this time round.

But it surely would possibly get extra consideration, although I’d nonetheless count on TikTok to stay in operation within the U.S., in some kind, after the divestment deadline passes.

Snap additionally notes that its “Snap Stars” program, which affords extra options to authorized, excessive profile creators, has helped to drive extra engagement with the entire time spent watching Tales from Snap Stars rising greater than 55% year-over-year in North America.

As per Snap:

“We onboarded over 1,500 Snap Stars in Q1, which has helped generate quarter-over-quarter development in Story posts, Highlight posts, and Tales time spent for Snap Stars globally.”

The initiative goals to maintain these excessive profile creators posting to the app, and that’s seemingly having a constructive affect on engagement.

When it comes to income, Snap introduced in $1,195 million for the interval, a rise of 21% year-over-year.

Snap says that enhancements in its machine studying fashions are driving higher outcomes for its advert companions, with small and medium sized advertisers, specifically, seeing important advantages.

“In Q1, ongoing momentum with our 7-0 Pixel Buy optimization mannequin – which permits advertisers to bid for attributed 7-day clickthrough conversions – led to a greater than 75% enhance in purchase-related conversions year-over-year. We expanded 7-0 optimization to app set up and app buy in Q1, and can broaden testing of extra app targets in Q2, which embody our capabilities to help Worth Optimization and Customized Occasion Optimization.”

Considerably superb, Snap additionally says that the variety of small and medium sized advertisers within the app elevated 85% year-over-year, which it attributes to its simplified advert creation course of.

I imply, that’s an enormous soar, and it’d be attention-grabbing to get extra perception into precisely how Snap has pushed such a serious enhance in uptake.

Snapchat additionally notes that Snapchat+, its subscription providing, is now as much as 9 million paying members, rising from 5 million in September final yr. Snap added an choice to reward Snapchat+ memberships again in December, and that appears to have had an affect on take-up over the Christmas interval.

That signifies that, at $US3.99 per member, Snap’s now making round $35 million per thirty days from Snapchat+. Which continues to be solely a fraction of its complete advert consumption ($100 million per quarter), nevertheless it’s a helpful extra income stream, which additionally reveals how subscription social can work, inside sure parameters and contexts.

Trying forward, Snap says that it expects to achieve 431 million each day energetic customers in Q2, with income steering between $1,225 million to $1,255 million, or development of 15% to 18% year-over-year.

These are good numbers for Snap, particularly after its less-than-amazing This fall efficiency replace. And whereas it nonetheless has a method to go in getting its enterprise again on monitor, the outcomes right here counsel that it’s specializing in the best areas, which can assist to usher in extra income from its key revenue areas.

![The Most Visited Websites in the World [Infographic]](https://newselfnewlife.com/wp-content/uploads/2025/05/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9tb3N0X3Zpc2l0ZWRfd2Vic2l0ZXMyLnBuZw.webp-120x86.webp)