With regards to acquisitions, Dixa’s CTPO Jakob Nederby Nielsen is a practitioner. He took half within the acquisition of three corporations. Every case was completely different, however all taught him the significance of aligning the objectives and minds of each events at each degree. Learn how he does it as he remembers the tales from this expertise.

The CTO vs Standing Quo collection is about drawing consideration to how CTOs problem the present state of affairs within the firm to push the enterprise in direction of new heights … or to put it aside from doom.

The if…else of enterprise acquisitions

We’re positive that you recognize the “if…else” assertion by coronary heart in a couple of programming language. However in the event you’ve by no means utilized it to the subject of acquisitions, listen.

An acquisition is a protracted journey and first. It is advisable to make sure the group heads in the correct course.

Jakob Nielsen believes that if you wish to purchase a enterprise, it is advisable to verify that:

- its mission is comparable sufficient to one in every of your group,

- its product experience is said however completely different sufficient to enrich the one in every of your crew’s.

If the reply is “sure” to each, you possibly can proceed with the acquisition. Else – abandon the trouble. It’s not price it.

Suppose you answered “sure” twice. Then:

- care for the clients of the acquired enterprise urgently,

- align your work tradition and enterprise objectives step by step however with no delay,

- outline the fascinating consequence of the acquisition and construct a roadmap to get there.

Sounds cheap, proper? However in the event you’ve by no means executed it, these are simply plain phrases.

Jakob will clarify how he developed that know-how and used it in apply all through the three acquisitions he helped finalize.

About Jakob & Dixa

Jakob co-founded Dixa in 2015 and helped it develop into a number one customer support platform whereas he grew into a real IT chief. He began as a Lead Frontend Developer, continued as a Senior Director of Engineering and a VP of Engineering, ultimately turning into a CTPO. Jakob is shaping the long-term product growth technique of Dixa, which entails the extremely advanced technique of integrating new acquisitions.

Software program engineering, Agile Venture Administration, Consumer Expertise, Venture Administration, Product Improvement

He spends most of his free time together with his household, however he additionally enjoys working outside when the climate permits or catching up on a number of the books he continually has on his to-read record.

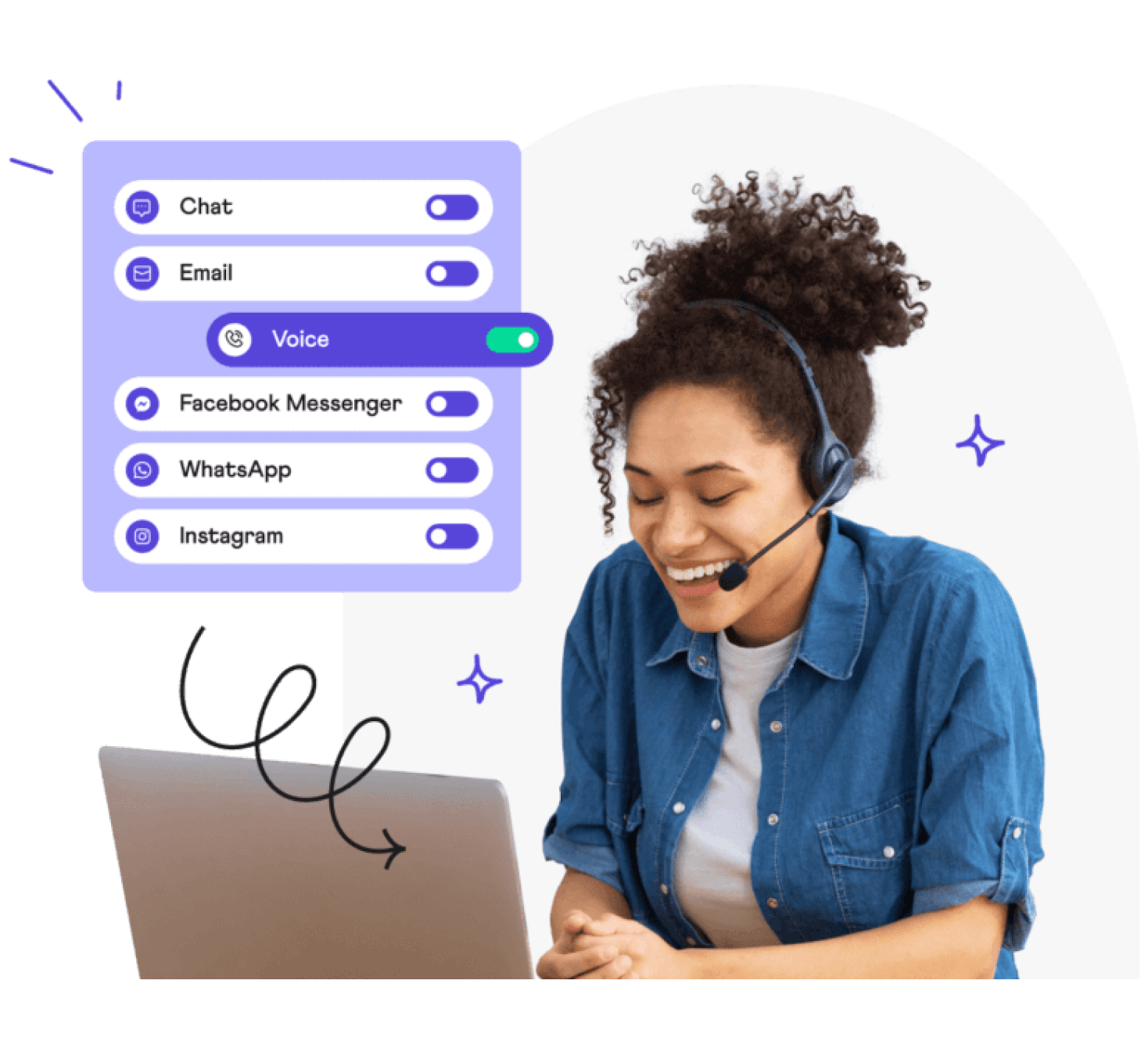

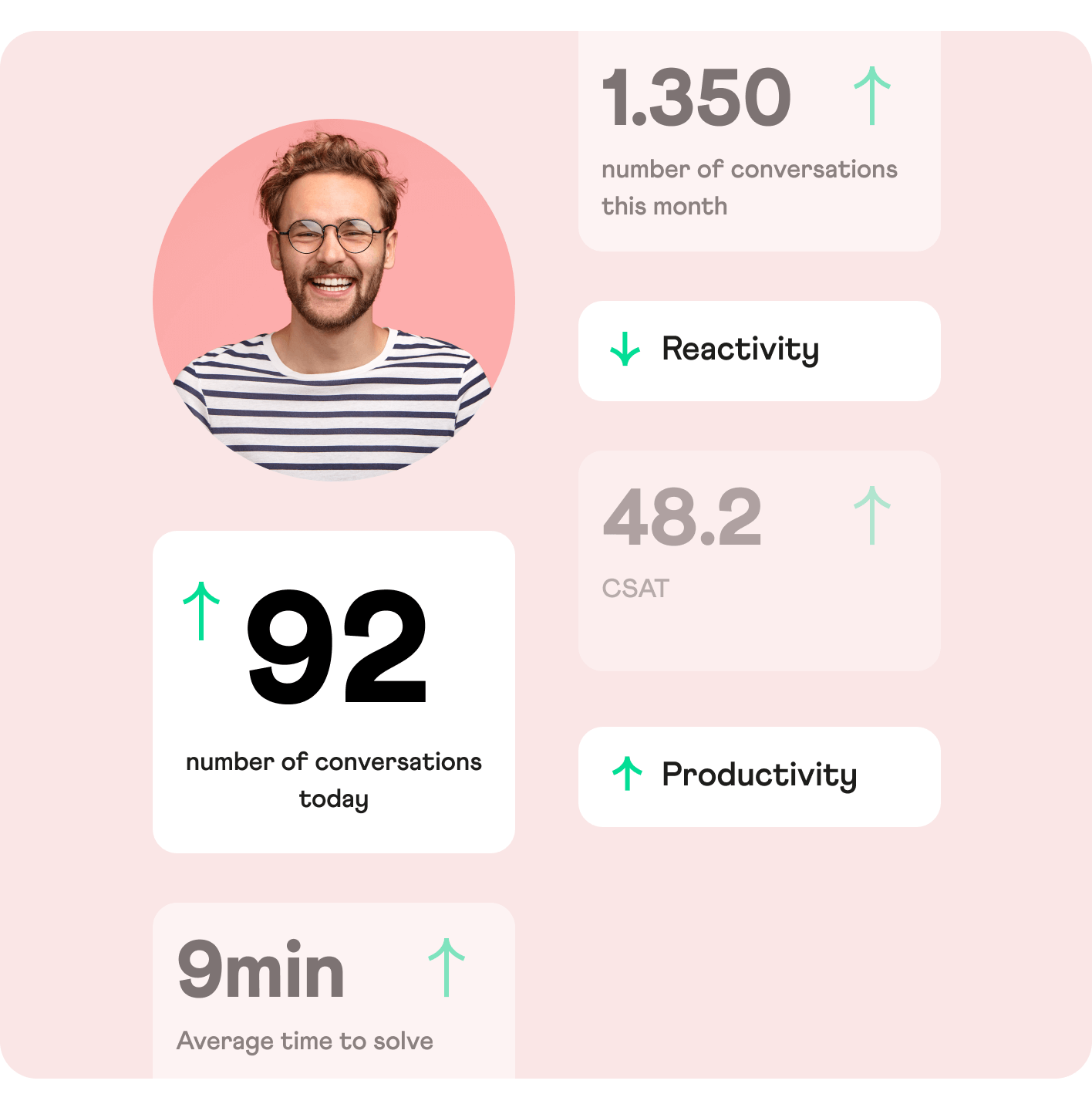

Dixa is a conversational customer support platform on a mission to empower corporations to construct long-lasting bonds with their clients at scale (Buyer FriendshipTM). They assist customer support leaders to create easy experiences for purchasers and groups that unlock loyalty. Dixa’s platform combines highly effective AI with a human contact to ship highly-personalized service experiences.

Since 2018, Dixa has powered a whole lot of hundreds of thousands of top of the range conversations for manufacturers like Whisker, Too Good To Go, Royal Design, Dott and GLS.

Find out how to put together your organization for brand spanking new enterprise acquisitions

Good day Jakob. Thanks for agreeing to the interview amid a busy time for Dixa. You’ve unveiled Mim, a brand new AI-powered chatbot, and a partnership with Ada, an AI-powered customer support platform. Dixa additionally obtained 40+ awards from G2. Congrats!

Are you able to inform us about Dixa’s plans for 2024?

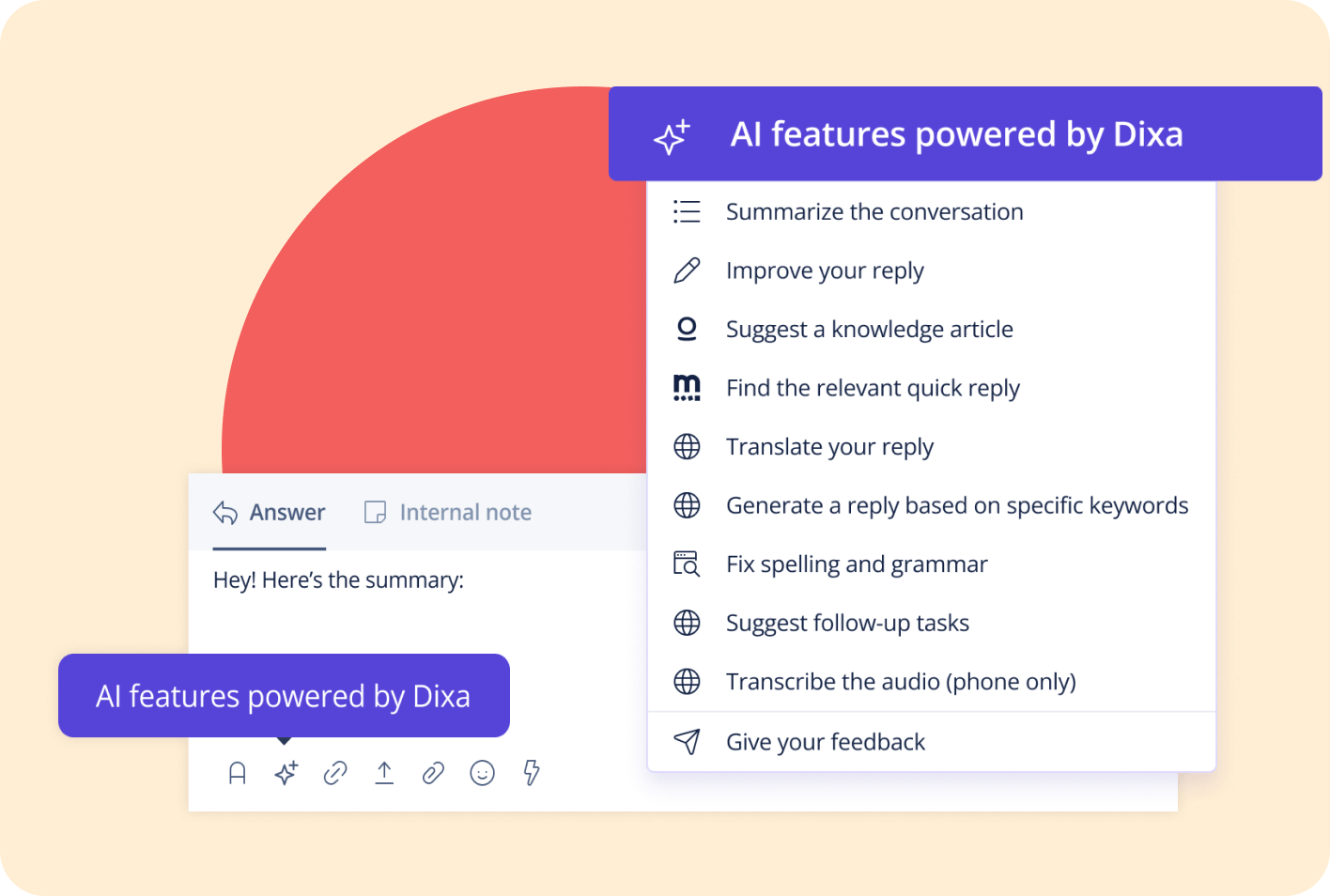

Thanks for having me. Dixa is certainly transferring in direction of AI. The chatbot and Ada partnership are part of the technique. We’re engaged on extra AI-based options.

AI is a pure extension of our customer support platform. Dixa’s mission is to empower buyer help brokers. We wish to make their work extra environment friendly and simpler. AI can help them in loads of methods, as an illustration, by providing good content material recommendations.

Past AI, we work on constructing sturdy partnerships. That’s a great way to amass extra experience. Ada has been within the AI sport for years.

Pre-acquisition

Collaboration with Ada is attention-grabbing. However previously, you’ve got already gone past partnerships and into acquisitions to increase the corporate’s experience. I wish to discuss it from a CTPO’s standpoint.

For starters: what are the everyday causes a SaaS firm acquires a enterprise somewhat than develops a brand new function from scratch?

Every acquisition case is completely different. I’ll use the instance of our first acquisition of Elevio. It’s a assist middle that serves as a wise product information hub.

It was a no brainer for us to amass it, as a result of it stuffed a lacking hole in our product portfolio. The technique has at all times been about our product portfolio and figuring out the lacking gaps. Then, we take a look at the market to seek out and assess potential sturdy companions to fill these gaps.

In addition to, our analysis proved that each corporations have been comparable. We used the identical cloud supplier and a comparable tech stack. Our work cultures have been comparable too. It was a match made in heaven.

The one draw back was that Elevio was positioned in Melbourne. The time zone distinction was 11 hours. That put stress on the crew collaboration, but it surely was workable.

What is strictly your position in an organization acquisition as a CTPO and a co-founder?

It’s primarily round deciding if it suits into our product mission. There must be a short-term good thing about buying their experience and a long-term potential for a full merger.

A giant a part of it’s tech due diligence, which entails validating if the to-be-acquired firm’s tech is scalable sufficient and if any technological issues might maintain us again.

Validating the tradition behind the tech can also be essential.

If you happen to don’t have a tradition match, all the things goes to be onerous. There are completely different philosophies of labor and cultural variations, even inside the similar business. When you have an organization with a really sturdy cultural basis, merging it with one other one which’s equally sturdy however completely different will end in clashes.

Seems like loads of work. Am I proper to imagine that the start of the acquisition course of is rarely easy in relation to merging the expertise and tradition of the 2 corporations?

Certainly. That’s why, if there’s a match, you need to make each events perceive that although the method goes to be lengthy and onerous, there’s a light-weight on the finish of the tunnel. Collectively, each organizations will likely be stronger, ultimately.

Individuals from all the businesses that now we have merged with took up management positions at Dixa. Many discovered broader and extra satisfying roles than they’d earlier than. There are many alternatives like this.

General, it’s a protracted journey. We’re not simply attempting to faucet into their income. The battle is about becoming the acquisition into our broad product technique in order that now we have synergy.

In addition to a tradition match, your organization additionally talks concerning the significance of aligning the aim and mission with those the buyout firm has. How do you confirm that?

You simply want to match your mission with that of the opposite firm.

One in all Dixa’s key differentiators is that we empower buyer help brokers as a lot as potential, giving them the liberty to behave. We aren’t constructing a micro-management instrument. We don’t construct instruments that you should use to regulate each transfer of your brokers. If that’s the mission of our potential companion, it’s not going to work.

There’s the thought of a buyer help agent sitting in an enormous corridor with headphones on, the bells ringing, and a giant dashboard shouting what number of clients wait in line. That isn’t the expertise we wish to characterize. We want a companion who shares our imaginative and prescient and should contribute one thing helpful to it.

What about their metrics? Some corporations that search for a merger could also be inclined to boost their product- and tech-related achievements slightly.

Our business due diligence covers that. As for the tech facet, there are some pretty goal issues to discover.

You could possibly confirm what number of clients they will onboard. Then, try their load testing in addition to penetration testing and compliance insurance policies.

That is on the guidelines we undergo with each acquisition. That approach, we make sure that there are not any bottlenecks. If we’re to load our total buyer base onto a brand new platform, we’d like certainty it may possibly scale to match our necessities. If it may possibly’t, we have to estimate the trouble it will take to vary that.

We undergo all that high-level stuff, however we additionally introduce a few of our tech folks to their engineers to determine what the numbers will seem like sooner or later. We ask: “Let’s say now we have a buyer with 1000 brokers going surfing subsequent week. What’s your sport plan? “

Whether or not the numbers are good or not, the customer must combine the bought product’s code into their structure, ultimately. What are the steps an IT division can take to arrange for that upfront?

The partnership part is the perfect time to determine these steps.

On this part, we talk about potential product integrations between the 2 platforms. There are a lot of challenges to beat. One of many greatest ones is solely the truth that each merchandise have already got many current and overlapping integrations with completely different platforms.

Issues are simpler if each events have the identical cloud supplier and use business requirements resembling Docker photographs, infrastructure-as-code software program, or Kubernetes. We will combine these into our infrastructure pretty simply.

Whenever you collect all of the tech stack data wanted, you possibly can create an integration plan. It ought to embody infrastructure points in addition to tooling, like incident & downtime administration, and buyer reporting. You must also merge standing pages so they’re the identical. Ensure that to sync the event of your stacks, too.

Is expertise ever a significant impediment for an acquisition? Or, if the product is an efficient match, will the patrons at all times discover a method to make it work?

I wouldn’t say that it could possibly be a dealbreaker.

We have now labored on a platform that had some architectural points. We labored them out, but it surely required effort. Specifically, altering the cloud supplier is just not a straightforward factor. You may’t do it in a single day.

You may make it simpler through the use of Docker or one thing else like that. Nonetheless, every cloud supplier presents many options which might be comparable to one another however not fairly the identical. You’ll spend a while migrating the code and sharpening it.

On the finish of the day, it’s about stacking the trouble towards the worth that you would be able to probably achieve.

Adjustments within the structure could develop into part of the street mapping effort. How early does the roadmap for an acquisition start for technical and product-related features?

First, it is advisable to respect the truth that the corporate you wish to merge with has its unbiased roadmap, clients, requests, and obligations. Sometimes, the partnership entails a stage at which nothing adjustments apart from the gradual merging of cultures.

We have now by no means fully shut down an aged, acquired platform, as a result of there are nonetheless clients that use it. Our effort has at all times been to create a greater product with the identical folks.

However in about half a yr because the merger, relying on the case, you begin to create a extra synergized roadmap. We would like each events to go in the identical course and determine what options we have to align. To determine this out, a expertise supervisor may strive a thought experiment: ask what you’ll do in the event you might construct a brand new platform from scratch.

There’s a must create not less than two methods. One for the acquired platform and a second one for the long run “fundamental” platform that may stay long-term. Ask your self what proportion of the purchasers can transfer to the “fundamental” platform when/you probably have the x function parity.

The trouble vs. anticipated worth at all times has to make sense when doing this.

I’m thinking about the way you overcome the doubts and fears of the purchasers of the soon-to-be-acquired firm. They might be afraid their favourite product gained’t be the identical and even distrust the brand new proprietor. What’s your expertise right here?

It’s vital to be very proactive.

As quickly because the announcement is made, attain out to the purchasers of the acquired firm. Share with them what occurred and what the long-term plan is.

If the acquisition plan entails a whole merger of the platforms, don’t conceal the data. You need to inform the purchasers why the change will likely be good for them. Present them the advantages, resembling new potential integrations and capabilities they will get.

We might by no means purchase a product that doesn’t naturally belong in our product suite. The acquisitions we made at all times stuffed out gaps in our portfolio. That made issues simpler. The shopper gained new options that complement the present ones they use.

What sort of options does Dixa supply precisely? Watch the video and uncover how Dixa empowers brokers to supply customized customer support expertise.

Acquisition

What’s the position of a CTPO within the formal execution of the acquisition?

I’m at all times a part of the acquisition crew to cowl the tech features of it.

That features assessing the potential of the tech and speaking with the founders and management.

I additionally cowl alignment, that’s, how we are able to work immediately with a view {that a} merger could occur sooner or later. That’s the start of the roadmap I discussed.

There’s loads of speaking to be executed. It is advisable to speak to the brand new folks, ensuring that you’re on the identical web page.

The market state of affairs is outdoors of my area. Others analyze that. However as a part of that course of, I want to make sure we will likely be able to producing software program for our shared product-market match as a merged product-engineering division.

Let’s speak concerning the adjustments a brand new acquisition brings to a corporation. What’s your expertise with integrating the buyout firm’s groups with yours?

Getting the information out of your CEO that you’ve been acquired has the potential to paralyze your on a regular basis work. Like I mentioned, it is advisable to have respect for the tradition, and it’s the individuals who create tradition.

The primary half of the yr needs to be pretty quiet. Guarantee staff that subsequent week, once they come to work, all the things will likely be largely the identical. However on the similar time, begin speaking about the way you create standardization throughout your platforms.

When you’ve got the standardization, you possibly can slowly transfer in direction of stage two of discovering the synergy. Let’s take a look at one in every of our examples.

Prior to now, Dixa acquired Miuros – a data-heavy firm. They’d a product for superior analytics. Additionally they had a QA instrument for buyer help brokers. Their analytics crew was analogical to our insights crew. They have been downstream groups, which signifies that they took information from different groups and transformed it to current it with the analytics instrument. Combining them made loads of sense.

Miuros’ crew was sturdy in enterprise evaluation. And ours had a robust understanding of Dixa’s core. They obtained collectively to create integration concepts through the use of their experience from each ends. That’s the way you create the synergy.

And as quickly as you’ve got that synergy, you possibly can strive merging the 2 groups.

On a unique word, this technique of integration can also be about folks attending to know one another. The easiest way to do it’s to prepare a get-together on-site. I missed the chance to do that throughout COVID.

Whenever you meet up, attempt to do one thing enjoyable. Exit for dinner, or to a bowling alley, or do some crew actions. It’s lots simpler to speak whenever you write and speak to an precise individual you met somewhat than simply their icon on Slack or a speaking head you see on a Zoom name.

What concerning the processes that drive your growth or deployment? How a lot can a brand new acquisition change them?

Most corporations that now we have talked to observe some business customary of software program growth. It’s some sort of Agile methodology that features planning, a standup, and a retrospective.

So now we have lots in widespread. However there are these micro-differences. Dash length differs. One firm has a standup at 9:00 within the morning, the opposite at 11:00. Such variations actually aren’t dealbreakers. They are often labored out over time.

It have to be even worse when the time distinction is 11 hours like within the case of the Melbourne-based Elevio.

That is additionally attention-grabbing as a result of we determined to maintain Elevio as a satellite tv for pc. We align on a strategic degree, however they’ve full operational autonomy. They resolve how they wish to work.

At Dixa, we at all times believed in giving autonomy to our product and engineering groups. They sit with the product crew every single day. They will see their product area full potential. So, in addition they have particular insights and distinctive cultures. Whether or not they resolve to do a stand-up at 9 or 11 am, I don’t care. The identical goes for his or her undertaking methodology. The important thing aim is just whether or not we ship high quality frequently.

It appears although that usually, the parent-company transforms the smaller yet another than within the reverse case. However maybe the smaller buyout firm also can affect the mother or father when it comes to work tradition. What did you study out of your managerial expertise?

It’s now at all times the case that the mother or father firm enforces requirements onto the acquired one.

We fill out a significant experience hole simply by buying a extremely specialised firm. However we additionally achieve extremely gifted people.

Among the folks from the buyout firm know run processes we haven’t launched but. If we resolve so as to add options they labored on earlier than to our platform, they would be the ones to handle and champion them at our group. They know precisely what to do.

We should be prepared for fixed change and to listen to different folks’s concepts. That’s important for getting higher. When you have this angle, there’s loads of information to obtain by going via an acquisition.

We talked about structure earlier than. After the merger, whenever you wish to combine the brand new product into those the corporate owns, what are the largest challenges of taking on the code?

There are some main obstacles.

For instance, in case your engineering crew makes use of practical programming, however the acquired crew focuses on class-based programming, it will likely be tough to combine the brand new people. That might name for a change of your entire programming paradigm for one of many teams. The skillset could be very completely different.

Nonetheless, it’s not a dealbreaker.

Alternatively, you possibly can create unbiased companies that may talk utilizing a typical API layer. Then, you possibly can have a number of unbiased groups engaged on the identical product.

There are all types of potentialities and workarounds in relation to integrating unbiased codebases or groups. However you want certainty that these scorching fixes don’t find yourself driving your architectural course. Alternatively, every acquisition will likely be yet one more reason for chaos and technical debt. When you have the perfect long-term curiosity of your organization in thoughts, decide your base applied sciences, frameworks, or structure, and attempt to match the acquired product into them.

Talking of technical debt, what concerning the buyout firm’s legacy options?

The factor about technical debt is that you just correctly generate some extra whenever you contact your code.

Debt is a pure facet impact of product growth that comes from the stress of deadlines.

However if you wish to proceed to construct and increase in your basis, it is advisable to spend money on fixing it, too.

The tech due diligence executed in the course of the acquisition course of goals to evaluate the quantity of technical debt and the trouble it should take to get it below management. A giant a part of the method is solely asking the correct questions resembling: “Suppose we wished to increase this function, what obstacles or limitations would we encounter?”.

With regards to studying about technical debt, an open dialogue should happen. As for the precise debt removing, it’s all about precedence and worth vs. efforts.

Safety points are one other sort of inherited debt that comes with an organization acquisition. How do you deal with such?

Penetration checks are a great way of assessing the safety of the bought software program.

You may carry out them or ask the buyout firm’s crew to do it. Alternatively, you possibly can contract a 3rd celebration to do it for you. There are loads of choices. Relying on the case, the pen checks can give attention to both the API layer, the appliance layer, or each.

Publish-acquisition

A CTO/CTPO who has by no means overseen an acquisition could surprise what the primary days or even weeks are like. How a lot time does it take to return to enterprise as common?

To start with, the adjustments are mild. The 2 organizations must get to know one another. Work normalizes whenever you attain an alignment and kind out cultural points.

I already talked about technological alignment. As for day-to-day work, I like to recommend that you just map out expectations of the way you need everybody to work. To that finish, run workshops throughout which the brand new people will work collectively together with your core crew. Whatever the particulars of the way you run such conferences, begin by gathering loads of information about all of the variations you wish to resolve. I already defined discover such data. However to recap – the partnership interval earlier than the acquisition is the perfect time to do it. It’s also possible to participate within the buyout firm’s retrospectives to get insights.

As for tradition, ultimately, your core crew and the newcoming crew are going to unify. Earlier than that occurs, the tradition of the mother or father firm performs a key position. If it’s forgiving and understanding, all the things will go smoother, and new teammates will likely be outspoken and proactive in resolving points. If that established tradition is poisonous and accusatory, newcomers will keep quiet. You’ll battle to maximise collaboration and also you gained’t even know why.

There are other ways through which a newly-bought product might be built-in. Within the case of Solvemate and Miuros, Dixa built-in their merchandise fully. However within the case of Elevio, plainly their software program was adopted in full by Dixa but it surely’s additionally out there as a separate product. Why is that?

It’s about market positioning. if the to-be-bought software program competes with what the mother or father firm has, it doesn’t make sense to maintain it as a separate product.

Elevio occurs to have an Preferrred Buyer Profile completely different sufficient from Dixa to face by itself.

What’s extra, Elevio is a wholly self-managed platform. You may join your self and add your bank cards. The operational value was an issue, however we invested of their backend and infrastructure. That spending included a migration into our AWS cloud to maintain the working prices decrease.

Common recommendation

Loads of the ways we talked about up to now are fairly situational or can work for a SaaS firm. Let’s attempt to generalize them. If you happen to have been to supply recommendation about enterprise acquisitions in IT that could possibly be helpful to anybody, what would it not be?

When it comes to the product match, attempt to discover one thing that would complement your owned product, in order that the brand new software program fills out a niche in your portfolio of companies. If you happen to determine a niche, and the potential acquisition suits it, the merger is a win-win for each events.

Then, it’s concerning the alignment of working types in addition to of the cultures. You need to work on discovering synergy between two groups from the partnership stage to the merger and past.

Technological variations might be obstacles, however they’re hardly ever a deal breaker if the product match is there. If that’s the case, there’s at all times some potential for alignment. Simply make sure that to suit the bought product into your long-term technological technique.

Assets

With regards to enterprise acquisitions, you sound like a real practitioner. And maybe there are some books or different supplies that helped you increase your experience?

I’m most positively a practitioner. It’s onerous to study concerning the acquisition course of by studying a ebook. That is one thing it is advisable to expertise. I used to be a part of such a course of 3 times. Every time, I realized a complete lot. I attempted my greatest to present you some sort of thought of the way it seems to be on the within.

Nonetheless, I can suggest a ebook that tackles loads of the problems extra typically. It allowed me to shine the managerial abilities that I used once I welcomed the buyout firm’s groups to the broader Dixa group.

It’s referred to as The Supervisor’s Path. It explains why one-on-ones are such a good suggestion and carry out them. It discusses the significance of the cultural side in product growth. It additionally has some nice insights into cross-functional groups.

It guided me from my days as a developer, via being a tech lead, supervisor, and the supervisor of managers, all the best way to the C-level.

What’s subsequent? The three alignments

Is there a enterprise acquisition on the horizon in your firm? If you happen to ensured that the enterprise is the correct match, and the potentials hardships didn’t put you off the thought, observe Jakob’s recommendation on alignment:

- Align goals

The partnership interval that usually precedes acquisition is the perfect time to work out the goals. At first, the 2 corporations have their very own routes. However as you observe the potential for synergies on the crew and particular person ranges, you will notice widespread floor.

- Align expertise

Concentrate on long-term success. Brief-term workarounds could produce tons of technical debt if taken to an excessive. Outline how toe two merger merchandise ought to perform in an ideal state of affairs. Then, work your approach in direction of it.

- Align tradition

Cultural variations between organizations are to be anticipated. How you’ll easy them out is dependent upon the tradition of the mother or father firm that leads the acquisition. After an acquisition you’ll finish with a brand new firm tradition. It will be important that you just give attention to this side pre- and post-acquisition. I’d put many of the give attention to cultural alignment as early as potential.

If you are able to do all that, all the things else will kind itself out!

Go to Dixa to study all the things about this complete buyer help platform

Learn buyer tales, discover out extra about its AI & automation options, ebook a demo.

![The Most Visited Websites in the World [Infographic]](https://newselfnewlife.com/wp-content/uploads/2025/05/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9tb3N0X3Zpc2l0ZWRfd2Vic2l0ZXMyLnBuZw.webp-120x86.webp)