Thanks CreditRepair.com for sponsoring this submit. CreditRepair.com’s group understands {that a} credit score rating isn’t just a quantity; it’s a life-style.

Credit score is unquestionably the type of factor that if you want it, you actually need it. You hear it time and again – ensure you have good credit score and keep credit score rating. And should you’ve ever tried to use for a automotive mortgage, lease an condominium or store round for house mortgage you understand how necessary it’s. Having credit score rating means if you do go and apply for these loans, you’ll be authorized with decrease rates of interest which relying on the scale of the mortgage can find yourself saving you hundreds of {dollars} over the lifetime of the mortgage. Decrease credit score scores, typically include mortgage denials and even should you do get authorized they arrive with a lot increased rates of interest. Meaning much more dough out of your pocket in the long term.

However we’re all human and errors with our credit score can occur if we’re not cautious. It did to me. I’ve all the time been vigilant about retaining my bank cards paid and on time to take care of an incredible credit score rating. However about two years in the past I used to be in the midst of a transfer and a bank card I had on autopay raised the minimal month-to-month cost on the cardboard with out my data and with out notifying me (sure, they’ll do that and there aren’t any legal guidelines stopping them). Despite the fact that funds had been made, because the new minimal cost wasn’t being happy it was then thought-about late. I had no concept. This firm filed a 30-day late cost mark in opposition to my credit score and refused to take away it although they eliminated all charges, acknowledged there was no communication and apologized for the scenario.

Even after years of nice cost historical past, this one little mistake precipitated an enormous 65+ level dip in my credit score. And as soon as your credit score dips you rapidly notice the way it impacts nearly each side of your monetary life and monetary freedom. Except you might have the money you possibly can not simply exit and purchase a home or automotive or house. The very fact is that decrease credit score scores can price you large $$$. After diligent work, I’m nearly again to the credit score rating I as soon as had of 750+. Fortunately our credit score scores aren’t set in stone and it’s by no means too late to get it again on observe.

In the event you’re seeking to rebuild or restore your credit score listed below are some tricks to getting your credit score hovering once more.

1. Know What You’re Working With… Get Your Credit score Report

Sadly, appearing as in case your credit score doesn’t exist isn’t going to make it any higher. The very first thing to do if you make the choice to restore your credit score is to get your credit score report to search out out what your scores are and what if any unfavourable marks you will have. The Federal Commerce Fee has made a legislation referred to as the Truthful Credit score Reporting Act (FCRA) that makes you entitled to 1 free copy of your credit score report each 12 months. It’ll have all three nationwide credit score reporting businesses scores and provide the data it’s good to get began in your credit score restore journey. Even when you already know you’re doing every part proper, there could also be data on there that isn’t right and affecting your rating.

2. At all times Get These Funds in on Time

This one may appear apparent, however it’s the primary greatest behavior when both making an attempt to lift your rating or preserve it on observe. In the event you discover it troublesome to recollect when your bank card funds are due, arrange alerts in your telephone or mark a calendar in your wall. Establishing autopay for as many funds as attainable will help preserve you on observe as properly. However even with autopay you should definitely be taught from my mistake and examine in along with your accounts to verify they’re being processed accurately. And bear in mind you don’t want to hold a month-to-month bank card steadiness to construct your credit score. Paying off your bank card payments each month can have simply as efficient.

3. Keep Forward of the Sport by Monitoring Your Credit score

Normally, after I hear phrases like “report” or “monitoring” I usually begin daydreaming about my weekend plans. However take heed to this…to get your credit score recreation on level it’s good to know what you’re working with. And which means getting alerted to any adjustments (good and dangerous) to your credit score. To make issues simple (we like simple), the CreditRepair.com credit score monitoring expertise gives their members with a private on-line dashboard, a credit score rating tracker and evaluation, creditor and bureau interactions, with textual content and e-mail alerts, cell apps and credit score monitoring.

? Loopy Credit score Reality: Proper now hundreds of thousands of Individuals have inaccurate or unfair unfavourable objects on their credit score stories which can be wrongfully hurting their rating.

4. Change Your Spending Habits – Cease Whipping Out That Credit score Card to Purchase Espresso

Bank cards are nice to have, however in case you are maxed out or near maxing them out your credit score rating will endure. Lenders sometimes prefer to see low utilization ratios of 30% or much less. Meaning should you add up the whole credit score strains throughout all of your bank card strains, something over 30% can negatively have an effect on your credit score rating. That additionally means cease utilizing them frivolously for every day frivolous issues like espresso. The truth is, simply cease utilizing them except it’s an absolute and whole emergency. And no, getting entrance row Taylor Swift tickets or that new $200 of restricted version sweatshirt that’s most undoubtedly going to be crumpled up within the backside of your closet three months from now usually are not emergencies. To maintain from utilizing them actually take the bank cards out of your pockets and put them in your nightstand or a locked field so that you aren’t tempted.

5. No matter You do, Don’t Shut Credit score Card Accounts

I get it. You need to get severe about your funds and boosting that rating. However do you know closing out bank card accounts if you nonetheless have a steadiness can harm your rating? Have you learnt that utilization rating we simply dished about? Canceling out playing cards will decrease your general accessible credit score quantity whereas elevating your credit score utilization which might usually decrease credit score scores.

A better credit-building technique is to maintain unused card accounts open and never utilizing them whereas paying others down.

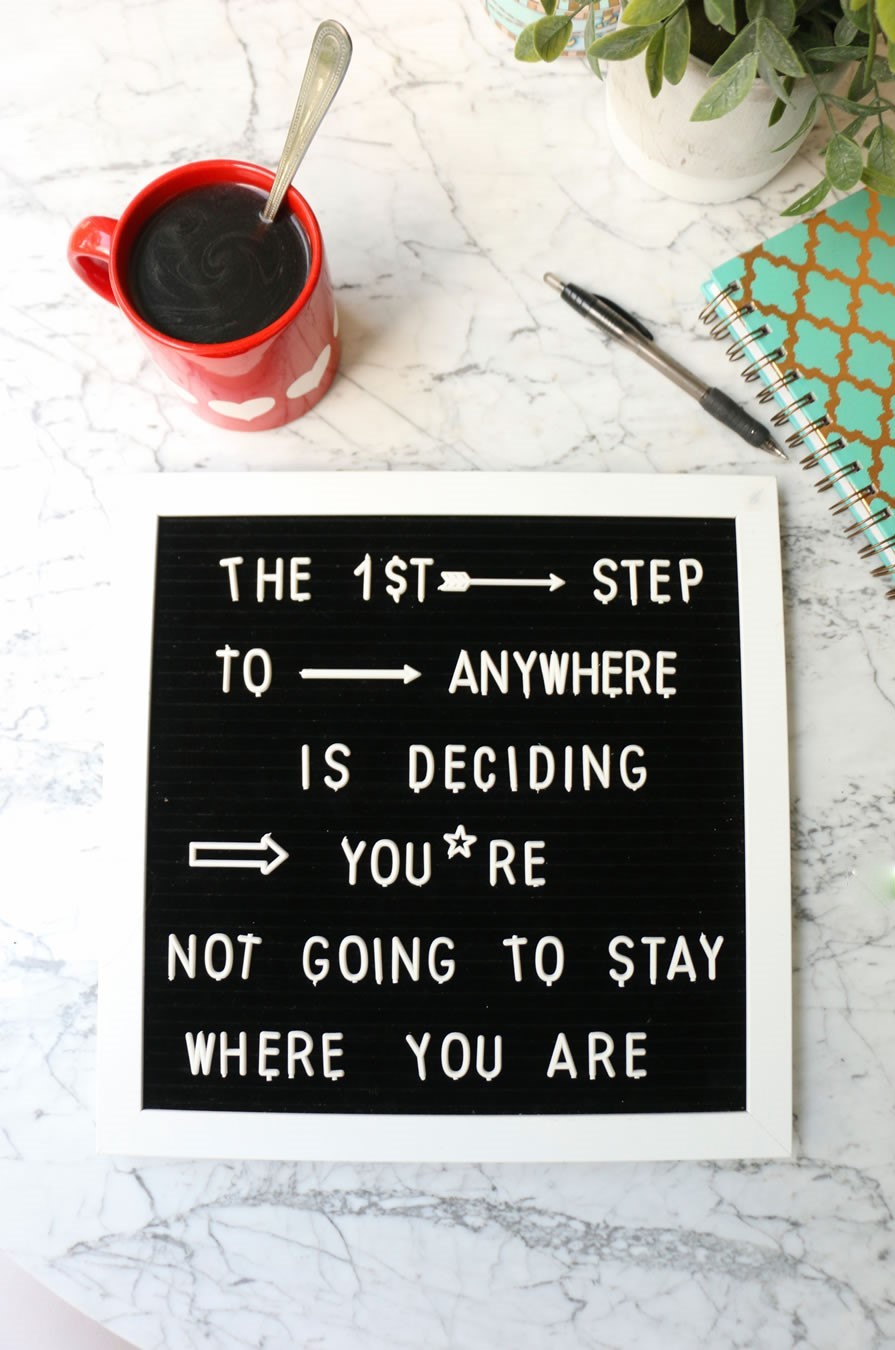

6. Don’t Obsess. Constructing Your Credit score Again Takes Time

There’s numerous issues that issue into how your credit score rating is calculated together with cost historical past, credit score size, steadiness quantities, whether or not you might have a mixture of credit score (bank cards are completely different than a mortgage, faculty, and automotive loans) if there’s any unfavourable stories and extra. Notice that whereas it would take months for some to construct their credit score, it could take a 12 months or two or extra for others. An important factor is committing to monetary freedom and taking cost of your credit score rating to get again on observe.

7. Don’t Beat Your self up Get Assist if You Want It

Whereas an incredible credit score rating could be necessary in serving to you obtain a few of your life’s monetary and way of life targets it’s nonetheless only a quantity. With time and somewhat diligence in your half, it is going to get higher over time. Sure, credit score rating can simply assist you to obtain your desires and dwell your life somewhat additional. However it’s not written in stone are you’re greater than a credit score rating. If you wish to repair your credit score however really feel overwhelmed, name CreditRepair.com for a free session. With over 500,000 shoppers already served, they’ve professionals that may assist information you thru the complicated and generally annoying credit score restore course of.

What’s your a bad credit score is costing you?

CreditRepair.com is a trusted chief in credit score restore! Go to them right now to start out climbing again to the highest. Know your credit score, restore your stories & dwell your life.