Disclaimer: Any opinions expressed under belong solely to the creator.

Over the previous few months, a brand new concern has been surfacing amongst prime executives at MAS- a query of whether or not rules that they put out may have the impact of legitimising cryptocurrency corporations.

MAS Chairman Tharman Shanmugaratnam’s feedback at January’s Davos Summit sum up their essential concern- that in regulating crypto, they might be inadvertently offering a stamp of approval and giving the flawed impression that crypto has lastly handed MAS’ checks.

It’s not tough to see the place Chairman Shanmugaratnam is coming from- the status that MAS has on the earth stage is considered one of a accountable regulator that’s none too eager to permit crypto in with out correct safeguards.

And MAS can be cognizant of the truth that in the course of the crypto winter, a number of of the most important crypto crashes had been of corporations primarily based in Singapore- albeit largely unregulated ones. Not solely that, however some in Singapore have additionally been vocal in questioning MAS’ choices at each turn- from suggesting that its strict necessities turned main corporations like Binance away, to questioning MAS’ competency when FTX crashed.

Certainly, MAS’ each transfer appears to attract scrutiny from all directions- and never all the time of the great type.

However this scrutiny is not any excuse for inaction- and for an {industry} as giant and vital as crypto, it’s all the extra vital that MAS forges forward with plans for regulation.

Regulation is a thankless task- however it’s needed all the identical

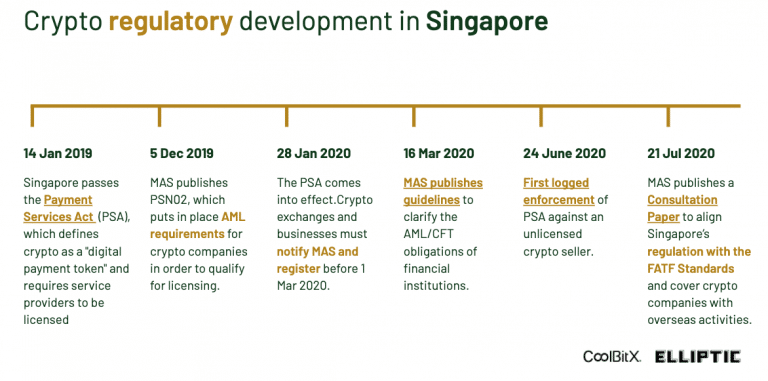

Singapore has always been forward of the curve on the subject of crypto regulation- whereas different nations have welcomed the funding and charged headlong into attracting funding, MAS has as a substitute taken a step again and questioned if crypto is basically one thing that we welcome.

And crypto fans haven’t been happy with MAS’ conclusions, to say the least. Many have accused MAS’ strict necessities of stifling innovation- however are its insurance policies actually that dangerous?

Regulators are within the enterprise of protection- requiring corporations to place in place ample safeguards earlier than partaking clients, and holding out corporations which are unsound or fraudulent.

Different nations have additionally been following our lead on the subject of crypto regulation. About two weeks after Tharman’s feedback that Singapore might regulate crypto corporations that supply companies just like these present in conventional finance, the UK additionally opened session on new guidelines for the crypto sector. The proposals into account included tips to control crypto asset actions underneath the identical regime as conventional monetary companies.

This will likely not, in itself show that MAS is perfect- however it’s maybe proof that there’s worth to be present in MAS’ concepts about how regulation needs to be carried out and the way regulators ought to formulate insurance policies and derive conclusions.

And the choice could be to disregard the crypto {industry}, and both implement a blanket ban on the {industry}, or permit any and all corporations to enter.

Letting all corporations enter is evidently a foul idea- the {industry} nonetheless has a protracted approach to go on the subject of self-regulation and removing unhealthy actors from inside its midst. This a lot has been made clear by the previous 12 months, with distinguished corporations collapsing and their founders falling from grace.

However a blanket ban too can be not the best policy- there are corporations with a real curiosity in offering crypto companies and options that may enhance the lives of Singaporeans and firms in Singapore.

Actually some corporations shouldn’t be allowed to arrange store here- however we must always not throw the newborn out with the bathwater and cease good corporations from coming too.

So actually, regulation of crypto is one of the best, and sure solely means for Singapore to operate- it permits us to draw good corporations, whereas holding out the unhealthy.

Will regulation actually legitimise crypto?

There is a vital distinction between legitimacy and authority- the place authority is imposed from above, legitimacy is given from under.

MAS will not be able to present crypto legitimacy- irrespective of what number of warnings that it points, it stays as much as particular person traders to supply it the legitimacy by shopping for into the token.

If there’s anybody guilty for the gradual legitimation of crypto over the previous few years, it’s not the regulators who’ve sought to civilise it, however the lots who’ve recklessly embraced it.

Regulation has all the time been about one goal- safety. Ever since crypto started to realize mainstream consideration, MAS has been warning the general public in regards to the dangers that investing in crypto would possibly entail- although such recommendation usually falls on deaf ears.

Is it proper, then, to recommend that the regulators are guilty for attempting their utmost to guard folks, after seeing the debacles at Terraform Labs, Celsius, and Three Arrows Capital?

Crypto regulation has grow to be a necessity exactly due to the failure of self-governance within the industry- and governmental oversight has now grow to be needed with the intention to comprise the harm.

To recommend that the implementation of tips for crypto corporations could be to legitimise crypto could be to disregard the huge publicity and hype generated by coin holders who’ve voted with their {dollars}.

As an alternative, regulation and regulators are coming in as a result of the dangers of such investments are too nice to disregard.

Crypto has not but expanded to the purpose the place fiat currencies in developed nations like Singapore are threatened with alternative. Nor have they solved the issue of scalability inherent inside cryptocurrencies.

The rationale why crypto requires regulation is as a result of they comprise the specter of misuse and malinvestment- and till the {industry} proves itself able to coping with these points, there’s not prone to be case for the authorities legitimising crypto via their actions.

Is crypto legitimation actually that regarding?

There may be actually some cause to strategy crypto regulation with warning. The {industry} has nonetheless not shed its picture of being one which criminals flock to for illicit actions.

On prime of this, the volatility of crypto costs and behavior from former {industry} leaders like Arthur Hayes, Do Kwon, and others haven’t precisely been successful followers with regulators.

If MAS now steps in and offers the inexperienced gentle to crypto, will it not ship the flawed message to customers in Singapore?

Will it then encourage extra Singaporeans to leap aboard the crypto hype prepare, and park extra of their hard-earned cash into tokens that would probably crash at any second?

Actually this end result is a risk, and one that’s removed from preferrred. However the various would possible be far worse.

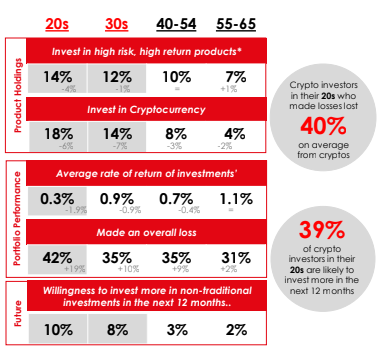

Singaporeans are already investing in cryptocurrency-regulated or not. And lots of are nonetheless eager to maintain on investing regardless of the current downturns and excessive profile crashes.

Is it the case that customers are investing as a result of they have no idea of the dangers that crypto brings? Most likely not. MAS has confused so many instances that retail funding in crypto is extraordinarily dangerous.

Any client who stays invested however doesn’t but respect the dangers of such investments most likely mustn’t even be allowed to take a position at all- not to mention in a discipline as complicated as crypto.

As an alternative, it’s much more possible that they’re investing, understanding the dangers of such actions, and accepting them.

However how far they’re able to perform their due diligence when investing their hard-earned cash into the house is one other subject.

Particular person customers are hardly able to compel corporations to launch info concerning their enterprise mannequin, income streams, or monetary statements. As such, they’re investing with lower than full information- maybe lower than what would usually be deemed accountable.

That is by far the worst state of affairs to be in. Shoppers will make investments regardless- and they’re doing so with out doing their due diligence.

MAS and regulators, then again, aren’t in such a place. Since they’re able to implement licensing necessities, they’re in a stronger place on the subject of negotiating with corporations on what info these corporations might be required to reveal, and what info can stay non-public.

This info can then be utilized by customers who want to make investments regardless of the a number of warnings of how dangerous the house is.

Admittedly, this would possibly give the impression that MAS is giving the inexperienced gentle to crypto- however at this stage, the purpose is moot.

Shoppers haven’t been delay by MAS’ repeated warnings, although I’ve little doubt that the warnings will maintain being issued. As an alternative, it’s higher to supply some extra info in order that these customers who’re prepared to danger their cash have that little bit extra info to guard themselves.

Although unlikely, some traders may even see the brand new info and realise simply how dangerous their investments are, and resolve to exit the house earlier than the following conflagration.

Legitimising crypto, as harmful because it appears, could be the subsequent needed step in defending Singaporean customers from any additional harm.

Featured Picture Credit score: World Financial Discussion board

![HTML and CSS for Beginners [Article + Tutorial]](https://newselfnewlife.com/wp-content/uploads/2021/04/BlogBanner_templates_InclusiveDesign-720x480-120x86.png)

![Tokinomo, A Startup ‘Adding Magic’ To In-Store Brand Activations Has Been Included At The NRF Innovation Lab — The Largest Retail Show On Earth [Press Release] – NogenTech](https://newselfnewlife.com/wp-content/uploads/2021/11/1_q_zt9ZpS81pYgQj2YZXXSg-120x86.png)

![How to Build a JavaScript Search [Article]](https://newselfnewlife.com/wp-content/uploads/2022/08/javascript-search_blog-120x86.png)