Snapchat added 12 million extra lively customers in This fall 2022, and Snapchat+ subscriptions proceed to rise, however firm income missed market estimates, in one other combined outcome for the personal social app.

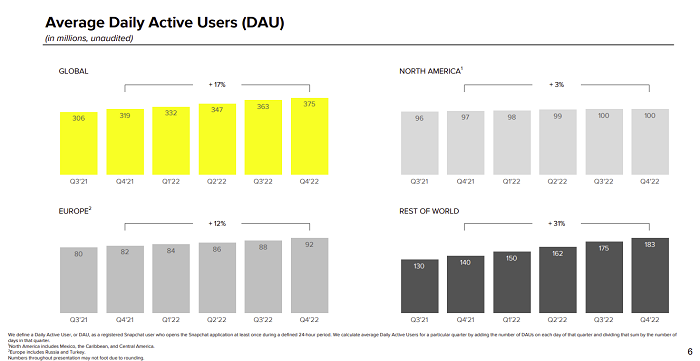

First off, on customers – as famous, Snap added 12 million extra actives, taking it to 375 million DAU.

As you possibly can see, North American person progress remains to be flat, whereas European customers noticed a slight uptick. However it’s the ‘Remainder of the World’, particularly India, which is driving Snap progress.

Which helps to spice up the general utilization numbers, and develop alternative. However on the income facet, it’s not pushing issues ahead in a big approach.

As you possibly can see on this chart, Snapchat’s income has elevated, however a key downside right here is that it’s nonetheless reliant on the US and Canada for almost all of that spend, with different markets trailing properly behind on the income entrance.

On this chart, you possibly can see that Snap’s Income Per Consumer has truly declined year-on-year – so whereas it’s rising, it’s not bringing in income at equal scale, and it’s even going backwards in some respects.

Which is why its stagnant progress in North America is an issue – although Snap has additionally seen take-up of its Snapchat+ subscription service enhance.

“In This fall, our subscription service Snapchat+ reached over 2.0 million paying subscribers. Snapchat+ presents unique, experimental, and pre-release options, and in This fall we launched new options equivalent to Customized Story Expiration and Customized Notification Sounds, offering subscribers with over 12 unique options.”

That’s a helpful extra income stream, however as with all social media subscription companies (together with Twitter Blue), take-up is mostly restricted, and at 2 million subscribers, that’s nonetheless solely 0.5% of Snapchat’s lively person base that’s been keen to pay further for these add-on parts.

Snap has additionally confronted challenges in rebuilding its advert enterprise, within the wake of Apple’s iOS 14 replace, which has impacted knowledge assortment, and Snap CEO Evan Spiegel says they nonetheless have some approach to go on this but:

“We proceed to face vital headwinds as we glance to speed up income progress, and we’re making progress driving improved return on funding for advertisers and innovating to deepen the engagement of our group.”

Snap has seen enchancment in its commerce integrations, which incorporates digital objects for Bitmoji avatars which Snap is ultimately trying to translate into real-world merchandise gross sales as properly. Snap additionally says that it’s facilitated over than 161 million product trials by over 35 million Snapchatters for Walmart, leveraging its Catalog-Powered Procuring Lenses at-scale.

These level to larger alternatives, however proper now, amid the broader financial downturn, and restrictions on knowledge assortment and focusing on, Snapchat is in a troublesome spot, and might be for a while but.

Basically, then, you’re banking on Snap’s future, and its superior instruments that would assist it higher align with expanded AR and VR use. And Snap is seemingly in an excellent place on this entrance – although once more, the impacts of the final 12 months, which additionally pressured Snap into lay-offs, may even have some impact.

Actually, then, the outcomes listed below are relative to your perspective.

For advertisers, extra Snap customers means extra potential attain – however most of Snap’s progress is coming from outdoors the US. Extra superior AR activations might change into a much bigger deal in future, but it surely is determined by the way you’re trying to join, and product match.

Buyers gained’t be overly pleased with the numbers, however there are constructive indicators on the horizon. It’s simply that the horizon, on this respect, stays properly within the distance at this stage.