Snapchat has shared its newest efficiency replace, reporting a rise in customers, however slower advert development on account of ongoing challenges within the digital adverts market.

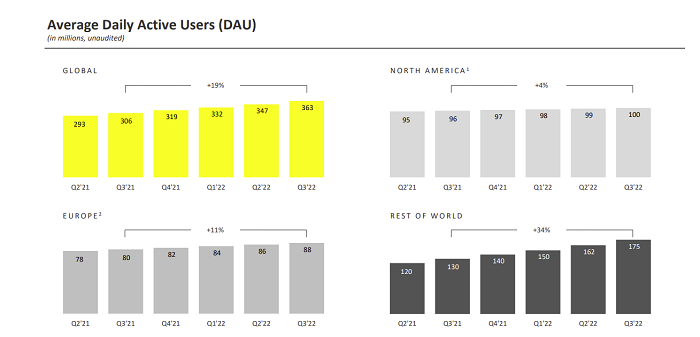

It’s a combined report – first off, on customers: Snapchat added 16 million extra day by day energetic customers for the quarter, taking it to 363 million DAU.

As you’ll be able to see in these charts, Snap remains to be seeing nearly all of its development within the ‘Remainder of World’ class, the place it’s added 45 million customers year-over-year.

The app has seen vital development in India, the place advancing cell adoption and enhancing connectivity are serving to it increase its attain and presence. Which is a constructive for the app’s longer-term potential, nevertheless it doesn’t present a significant enhance for the app’s income proper now, no less than not in the way in which that including customers within the US would.

Snap additionally says that total time spent watching content material within the app continues to rise, pushed primarily by Uncover and Highlight.

“We grew international time spent throughout our content material platforms by persevering with to spend money on personalization, driving extra subscriptions to creator content material, enhancing content material rating via higher understanding of recent Snapchatter pursuits, scaling our Creator and Accomplice ecosystem, and investing in operations to maximise return on content material provide and capability.”

On Highlight, particularly, Snap says that whole time spent viewing Highlight content material has elevated by 55% year-over-year, whereas over 300 million customers now interact with Highlight content material each month.

Like all platforms, short-form video has been a winner for Snap, and whereas Highlight is just about a direct copy of TikTok, the numbers right here underline why the platforms do latch onto vital developments like this, as a method to maximise engagement.

It’s not authentic, no, nevertheless it works in maintaining customers in-app for longer, versus them switching to a different platform for a similar.

And provided that Snap has additionally seen a continued downturn in engagement with Good friend Tales, it wants to search out new methods to maintain folks interacting, and spending time in app, even when content material from their direct connections isn’t as huge a lure.

Although it is a regarding development observe:

“Complete time spent watching content material in the USA decreased 5% year-over-year because the diminished depth of engagement with Good friend Tales was not absolutely offset by the expansion in viewership and development in time spent with Uncover and Highlight within the US.”

That’s particularly related once you take a look at Snap’s income stats:

As you’ll be able to see right here, whereas Snap introduced in $1.13 billion for the quarter – a 6% year-over-year improve – its revenue is vastly reliant on the US market.

If Snap’s seeing a downturn in US person engagement, that’s an issue, and it’ll be an necessary factor to trace in future efficiency updates.

“Our enterprise continued to face vital headwinds within the third quarter, and we took motion to additional focus our enterprise on our three strategic priorities: rising our neighborhood and deepening their engagement with our merchandise, reaccelerating and diversifying our income development, and investing in augmented actuality.”

Hit by impacts on account of Apple’s ATT replace, and the worldwide downturn in digital advert spend, Snap’s income development isn’t on the ranges that it, or the market, would hope. However it stays assured in its technique, which is delivering extra energetic customers.

“Promoting revenues comply with engagement, so whereas we face near-term headwinds to our income development, we stay optimistic about our long-term alternative based mostly on the expansion of our neighborhood and engagement.”

Snap’s additionally seeking to faucet into the recognition of Highlight as one other advert driver, with a variety of recent advert assessments.

“We imagine that Highlight affords an thrilling new means for manufacturers to experiment with video inventive and learn to make content material that evokes the Snapchat neighborhood. We’re additionally engaged on new instruments that allow companies to simply promote their most partaking Highlight content material, drive conversions, and measure their success with Advertisements Supervisor.”

That will additionally, presumably, contain a degree of income share for Highlight creators, who at the moment don’t have a direct monetization pathway, aside from Snap’s Highlight Rewards program.

Snapchat additionally says that it’s ‘utilizing this interval of lowered demand’ to implement upgrades to its advert supply platform and public sale dynamics.

Snapchat’s additionally shared a brand new stat on Snapchat+ subscriptions, noting that it now has greater than 1.5 million paying S+ subscribers, up from the million it reported again in August.

It’s onerous to say whether or not add-on subscription parts will turn into a sustainable income pathway for social apps, however Snapchat+ is offering some aid in offsetting Snap’s advert losses, which is a constructive for the platform at this stage.

Extra lately, Snap has additionally made partaking older audiences a spotlight, which has produced some outcomes:

“Every day common time spent for Snapchatters aged 35 and older partaking with Reveals and Writer content material elevated by greater than 40% year-over-year.”

If Snap can get this factor proper, and preserve extra older customers within the app, versus seeing them drift off from what’s historically been a youthful platform, that might assist it reinforce its development numbers – and as Snap notes, that, ultimately, ought to see advert income improve in-step.

However Snap’s actual future might effectively lie in AR, the place it stays the market chief in most respects.

Snap’s AR experiences are extra refined, extra partaking, and extra prone to go viral than these in different apps. Each time a brand new AR development comes up – from dancing hotdogs, to aged up results, to anime characters, to crying face, it’s Snapchat that’s the supply, whereas its superior AR instruments for purchasing are additionally opening up new alternatives for manufacturers throughout the board.

There are some regarding indicators right here for Snapchat’s total utilization, and fewer revenue leaves much less cash for funding in its personal AR glasses. However Snap’s reference to AR builders, and inner inventive nous, leaves it well-positioned to stay a vital platform within the subsequent stage of digital connection, even the metaverse, which would require 3D objects and experiences.

Possibly, then, Snapchat’s future isn’t even the app itself. I imply, it has lengthy referred to as itself a digital camera firm, not a social app.

Total, it’s tough to take lots from Snap’s newest report, as a result of total market developments are weighing on its outcomes, and its relative development stats look fairly stable.

However decrease engagement in key markets is a priority, even with extra customers coming in. I’d say that that is the largest takeaway right here, that Snap could also be seeing the beginning of a broader utilization shift away from the app.

It’s too early to mark this as a development, however Snap might have to evolve its enterprise past the app to really maximize its potential.