The blended outcomes maintain coming from Pinterest, which has as we speak revealed its Q2 2022 efficiency replace, which reveals no development in energetic customers, and decrease than anticipated income consumption.

Nonetheless, analysts noticed numerous positives within the numbers, significantly contemplating that they weren’t as dangerous as some had anticipated, given the broader financial downturn that’s impacted all social apps.

And there’s one other necessary level of word that might play a key function in Pinterest’s future path.

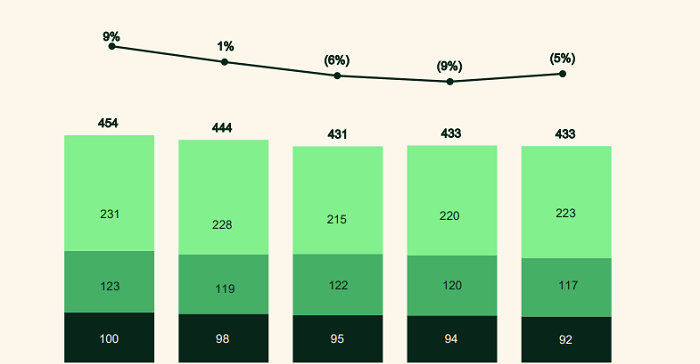

First off, on customers – Pinterest stays at 433 million month-to-month actives, the identical determine that it posted in Q1, when its person rely began to maneuver in the appropriate path as soon as once more.

As you possibly can see right here, amid the pandemic, which pressured extra individuals into on-line buying, Pinterest noticed a giant bounce in curiosity, reaching 478 million actives at peak. However as COVID restrictions have eased, and bodily buying has resumed, these numbers have steadily declined – although Pinterest did add a further 2 million within the final reporting interval.

That, traders hoped, meant that Pinterest had reached its low mark, and would now stabilize and transfer again into development. Which appears to be holding to a level, and given the aforementioned impacts on the broader market, which have dragged down the outcomes of all platforms, it looks like an okay end result.

Pinterest noticed its greatest declines in Europe, the place Russia’s invasion of Ukraine has had, and can proceed have, a variety of ongoing impacts. Pinterest’s greatest development, in the meantime, has come within the ‘Remainder of the World’ class, which incorporates Latin America, the place the platform is seeking to maximize its enterprise alternatives, together with creating markets like India and Indonesia.

That would sign vital alternatives for the app in these areas, with Latin America internet hosting some 80 million Pinterest customers alone. And as its Common Income Per Person charts present, areas exterior of the US have an extended method to go in catching up.

Pinterest remains to be within the means of rolling out its advert platform to all areas, so there’s much more potential there, which is partly why traders are nonetheless constructive concerning the platform. That, together with the revelation, as reported by TechCrunch, that Elliott Funding Administration not too long ago took a 9% stake within the firm, making it the one largest shareholder within the app.

Which could possibly be factor – Elliott Administration has a monitor report of shopping for up belongings in firms that it believes could possibly be performing higher, then utilizing its ensuing affect to instigate efficient change. Which is what led to Twitter ramping up its strategic plans, within the lead-up to the Elon Musk takeover push – however that might additionally imply that Elliott may also be pushing for comparable modifications and improvement acceleration at Pinterest at some stage too.

Which may squeeze more cash out of the app, however it might imply a shake-up for these concerned.

As per Elliott Administration:

“Pinterest is a extremely strategic enterprise with vital potential for development, and our conviction within the value-creation alternative at Pinterest as we speak has led us to grow to be the Firm’s largest investor. Because the market-leading platform on the intersection of social media, search and commerce, Pinterest occupies a singular place within the promoting and buying ecosystems, and CEO Invoice Prepared is the appropriate chief to supervise Pinterest’s subsequent section of development. We commend Ben Silbermann and the Board on the management transition, and we sit up for persevering with our collaborative work with Ben, Invoice and the Board as they drive towards realizing Pinterest’s full potential.”

Appears harmless sufficient, however it’s additionally a little bit ominous when you recognize of Elliott’s previous initiatives as an activist shareholder group.

By way of income, Pinterest remains to be bettering, bringing in $665.9 million, up 9% year-over-year.

Once more, you possibly can see, from these charts, the potential for development, and you’ll wager that Elliott can be pushing Pinterest to capitalize on these alternatives sooner relatively than later.

Incoming CEO Invoice Prepared, who got here throughout from Google in June to take the reigns from founder Ben Silbermann, could also be in for a difficult time forward as he works to handle expectations round such, whereas additionally maximizing improvement sources and development.

And this received’t assist:

“Our whole prices and bills grew 29% yr over yr attributable to headcount development in addition to elevated infrastructure spend.”

Extra performance requires extra funding, and as Pinterest grows its advert platform, and engagement instruments, it’s pumping extra cash into improvement.

On this entrance, Pinterest has additionally launched a brand new app, referred to as Shuffles for placing collectively collages utilizing images.

Undecided that it provides a lot to the general Pin expertise, however it factors to the app’s ongoing path, and give attention to constructing in new components.

In its accompanying notes and earnings name, Pinterest has outlined its key areas of development, with video now as much as 10% of time spend within the app.

And like all apps, Pinterest can be seeking to transfer into line with the short-form video pattern.

As per Pinterest CFO Todd Morgenfeld:

“We’re seeing relevance virtually at parity throughout Thought Pins and our static pictures, which is a giant enchancment.”

Wanting forward, Pinterest has forecast ‘mid-single digit’ income development for Q3, whereas bills will develop ‘within the vary of 35-40% yr over yr’.

So once more, a blended bag of outcomes and insights, which both counsel that Pinterest is stabilizing, and could be about to see a major enhance in development and exercise. Or that it must restrict its bills, as a way to maximize its consumption.

Both path may have a huge impact, and it’ll be attention-grabbing to see if Pinterest accelerates its launch schedule within the second half of the yr.