The lately introduced enhance of Items and Companies Tax (GST) to eight% and 9% within the coming two years has led to largely damaging reception by the Singaporean public. Nevertheless, whereas no one likes taxes to go up, it’s essential to see issues in a correct context.

Firstly, by world requirements, the oblique tax on consumption within the city-state is among the many lowest within the developed world. In comparison with OECD international locations (word: Singapore just isn’t a member of the organisation), the city-state would rank third from the underside — and that is solely after the complete GST enhance.

Some individuals prefer to argue that many of those international locations have decrease VAT charges on issues like meals, medicines, power, books which helps cut back tax burden on extraordinary individuals — and that is true (although in a few of them, even lowered charges are increased than Singapore’s GST).

What is commonly forgotten within the debate is that the city-state employs GST reduction instruments as nicely, by way of a voucher/money system that’s serving to the needy in a direct means. It’s a unique method and one that’s, arguably, much more cheap.

In a reduced-rate system, all people pays decrease VAT on sure items, no matter how rich they’re. A millionaire household or a flowery restaurant pays the identical low tax on meals gadgets than pensioners doing their buying. The truth is, each firm or particular person within the economic system enjoys the reductions in the identical means.

In Singapore, all people pays the identical tax on all the things on the counter, however the needy receives GST reduction to their utilities, top-ups to Medisave or money, having a portion of the tax returned on to their pockets. It’s far more focused and fewer wasteful (in any case, what’s the purpose of giving rebates on consumption to the richest?).

In different phrases, not solely do all Singaporeans pay a lot much less in GST than individuals in most developed international locations pay in related taxes on overwhelming majority of services and products, however the poorest nonetheless obtain direct assist to scale back their payments.

This, nonetheless, doesn’t but clarify the largest achievement of the little city-state: why is the tax so low within the first place (notably as each earnings taxes and company taxes are low as nicely)?

GST in Singapore must be at 21% – or over

You see, if Singapore was run like every other nation, the GST would seemingly be within the vary of 21% to maybe 27%, broadly the identical as VAT in Europe. That is how a lot could be wanted to steadiness the funds.

The explanation it’s not essential lies in nation’s reserves.

GST income in 2022 is projected to succeed in S$12.8 billion, on the prevailing charge of seven%. The federal government hopes to realize about S$3.5 billion yearly after the GST is raised, to assist pay for quickly rising healthcare prices.

In the meantime, the Internet Funding Returns Contribution (NIRC) — the portion of earnings from the funding of nationwide reserves — is anticipated to exceed S$21.5 billion, up from about S$20 billion final yr.

The truth is, NIRC accounts for over 20% of the nationwide funds and is the one largest income. Additionally it is distinctive in that nearly no different nation on this planet enjoys related inflows.

All people else should make do with no matter they accumulate in taxes. Plus, they usually need to pay hefty curiosity on debt, as governments run steady deficits, spending greater than they generate.

For every share level of GST, Singapore collects about S$1.75 billion.

With out NIRC, it must discover one other S$21.5 billion to cowl its bills. To finance it with GST, it could be pressured to — on the very least — enhance it by over 12 share factors, from 9% to 21%, simply to keep up the present degree of income.

- Larger taxes imply increased costs, so individuals spend much less cash, decreasing consumption and thus, the tax base.

- With increased tax charges, the motivation to evade them grows. Consequently, so does the hole between theoretical most and what the IRAS would be capable to accumulate.

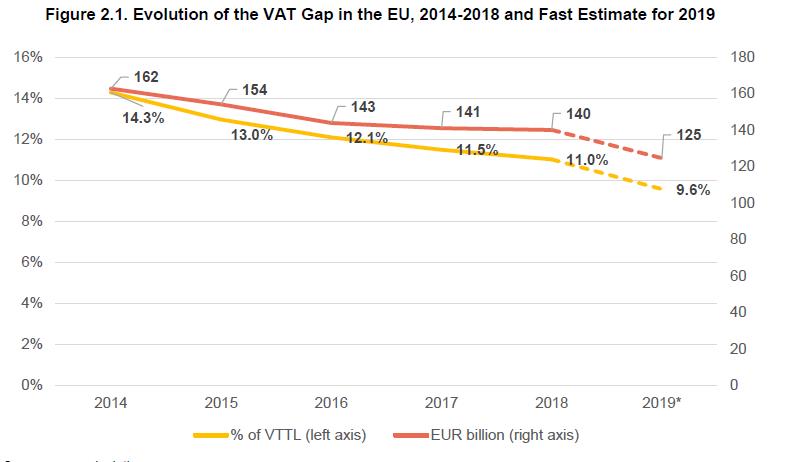

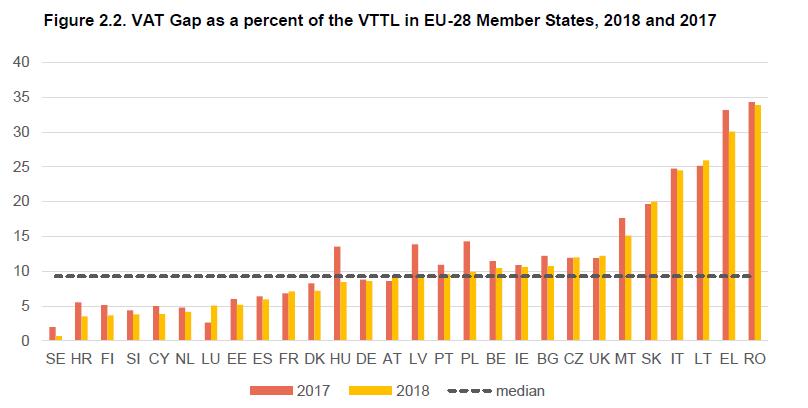

The latter is known as the VAT/GST hole and, as you may see beneath, it has been on common a whopping 10% of projected tax revenues within the EU international locations, with some failing to gather greater than a 3rd of what they might usually count on, as a result of tax dodging and lax enforcement.

(VTTL stands for VAT Whole Tax Legal responsibility – the anticipated revenues from the tax)

Consequently, the GST charge would seemingly enhance by no less than a number of share factors extra to reach on the lacking quantity. 23? 24? 25? All of those may be discovered within the EU.

Alternatively, the federal government may enhance earnings taxes, however the latter must develop considerably for the bottom taxpayers, as already 80% of PIT is paid by simply 10% of the wealthiest Singaporeans.

Growing the charges on the richest may result in capital flight and tax avoidance/evasion, destroying Singapore’s (comparatively) low tax enchantment.

Fortuitously, these nightmare eventualities are only a cautionary story of what may have been, however doesn’t need to and won’t be.

Singapore has prudently saved and invested budgetary surpluses in addition to overseas forex reserves for a lot of a long time, and right this moment it may rely upon them for a steady, excessive income filling the funds, stopping the federal government from having to make drastic spending cuts, elevate taxes to European ranges or, heaven forbid, really borrowing to finance annual budgetary expenditures.

That’s why, whereas many are sad in regards to the GST bump, the truth is that it’s nowhere close to what it may – and in every other circumstances could be.

Featured Picture Credit score: ASEAN Briefing