Submit Views: 71

And not using a plan, you can’t begin a enterprise. With out staff, a enterprise can’t survive. With out payroll, the staff can’t work with dedication. So, if in case you have completed the primary two then the payroll stage is most essential. An environment friendly payroll course of is as essential as oxygen for a human being. Or it’s not incorrect to say that its perform is like salt in meals. Whether it is working correctly, you hardly discover it. If it’s not working correctly, then you possibly can hardly deal with anything. And an efficient payroll course of wants payroll safety to tighten your small business.

Additionally learn:

Fundamental Trade Advertising Ideas For Rookies

Why Each Entrepreneur Ought to Have a Enterprise Mentor?

Fundamental necessities for payroll course of

Payroll safety can’t be dealt with with out the correct configuration of staff’ knowledge. The professionals of the accounting division must deal with the information of each particular person worker in your small business. You want the next knowledge to run a payroll.

- Identify of worker

- Age

- Gender

- Pay-scale

- His nationwide Identification Card quantity

- Checking account particulars

- Federal Tax data

- Federal Employer Identification Quantity (EIN)

- Contact data

- Handle

- Financial institution assertion every time pay is deposited in his account

This was the essential data wanted for a refined payroll. An ideal payroll course of is standardized, accessible, safe, seen, and present.

Why is payroll safety wanted?

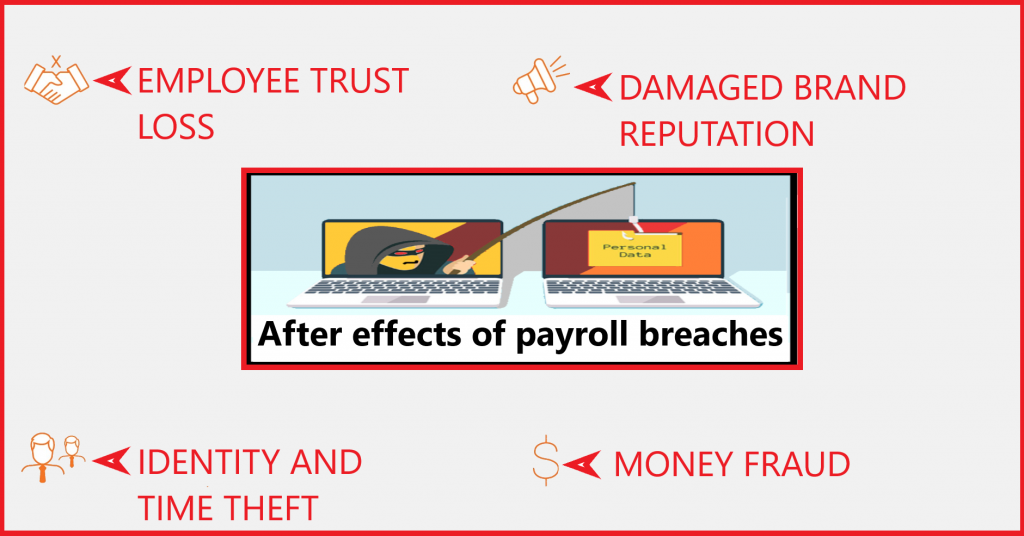

It’s essential to safe the delicate data of an organization, its staff, and its shoppers. Payroll safety consists of the important steps which can be taken to make sure the protection of staff’ data in order that any hackers or exterior actors can’t attain them. Frequent payroll safety points might embody knowledge breaches, timesheet fraud, alterations in pay charge, and so on. Largely, the character of those points varies in line with the kind of enterprise.

Listed below are just a few ideas that may help you to boost your small business’ payroll safety.

Preserve a report of precise payroll checks

Though, you don’t must imprint the whole social safety knowledge of your staff on checks or to make another blunder like that. Somewhat than that, hold a report of the paychecks that haven’t been distributed to the staff but. Additionally, hold all of the checkbooks (particularly clean checks) in a protected place. Ensure to have a refined system for accountability of individuals which can be organized by your organization to signal the checks.

Correct coaching of staff concerning the utilization of payroll safety programs.

Ensure to launch a correct payroll safety system. The subsequent step is to inform your workers concerning the system. Organize a correct coaching session to your staff to inform them the nitty-gritty of this method. Preserve previous staff up to date with new developments within the system. Additionally, prepare the brand new workers on the correct use of your organization’s payroll system. It’s also an opportunity to coach the associated workers on additional steps that may be taken for the safety of the group’s knowledge and information. Additionally, make it possible for associated workers ought to have correct entry to your system’s irrelevent security measures.

A enterprise/firm proprietor also needs to regulate the staff in order that they could not minimize corners and cheat him in the course of the payroll safety course of.

Payroll security-a elementary in enterprise’ safety coverage

Simply as you publish a journal or a paper on which you write all the safety methods and procedures, be certain to make payroll safety the primary precedence. It consists of making insurance policies which can be comprehensible and accessible for the staff.

Following measures are essential to tackling payroll fraud:

- Earlier than hiring a brand new worker, clear all of the dues and background checks of previous staff.

- Correct configuration of the staff and restrict their entry in line with wants.

- An worker mustn’t have full entry to the non-public data of different staff.

- Launch a software program or filter corresponding to an Automated clearing home (ACH) that may forestall your small business checking account out of your rivals.

- Direct deposit is safer for workers than printed checks as a result of, within the latter one, probabilities for payroll fraud are extra frequent.

Launch a payroll safety software program

It’s a world the place know-how is doing wonders on daily basis. You can’t be profitable in case you are not protecting your tempo alongside the velocity of know-how. You want to replace apps usually in your cellphone. Equally, you have to replace your payroll safety system usually. As a result of an outdated and worn-out safety system can expose your knowledge to hackers and lots of safety threats. Updates are additionally essential to counter the brand new deceitful methods and newest knowledge breaches.

Replace login data usually

After following the above step, now your system is up-to-date. However that’s not sufficient. Set your system in such a method that it should demand the customers to replace their password usually after a hard and fast time. It may be completed constantly after a time vary of 15 to 90 days. This frequency relies on the kind and necessities of your small business. Ensure to maintain your workers conscious of those system necessities throughout their payroll safety coaching program. It’s a really efficient step, particularly in opposition to password breaches.

Conduct common audits of payroll

An everyday audit of payrolls assists enterprise house owners to reduce breaches, safety threats, and white-collar crime. It additionally retains you on the protected aspect as a result of whenever you audit your payroll knowledge usually, you routinely comply with the labor legal guidelines and tax guidelines. Most businessmen audit their payrolls yearly however a month-to-month audit or an audit after 6 months may be extra environment friendly.

Cut back time-sheet falsification

It’s a kind of breach that features staff purposely misrepresenting the period of time (they’ve spent on work ) of their time charts. Most payroll safety programs include an enormous vary of options that cut back the possibilities of time theft.

![The Most Followed Gen Z Celebrities on Instagram [Infographic]](https://newselfnewlife.com/wp-content/uploads/2025/09/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9tb3N0X2ZvbGxvd2VkX2dlbl96X2NlbGVicml0aWVzMi5wbmc.webp-120x86.webp)