Banking like many different industries has been present process a steady digitization course of for a while already. Digitization within the banking sector triggered large transformations, encouraging banks to seek for customized finance software program improvement companies to construct digital banking options. With all this, banks have began adopting digital advertising methods from e-Commerce to enhance their stage of companies and preserve their prospects’ satisfaction at a excessive stage. Considered one of these methods was to undertake a multi-channel strategy to supply customer support throughout varied channels.

The multi-channel mannequin has change into an excellent basis for additional digital ecosystem improvement – the omnichannel strategy. Omnichannel banking options permit monetary establishments to interconnect their promoting and communication channels, offering a complete banking expertise to their prospects. Within the post-pandemics instances, when companies more and more depend on digital options, banks need to quickly think about the potential of shifting their customer support fashions from multi to omnichannel.

On this article, we’ll look into the main points of omnichannel banking and its benefits, and clarify why banks want to contemplate its adoption instantly.

What Is Omnichannel Banking?

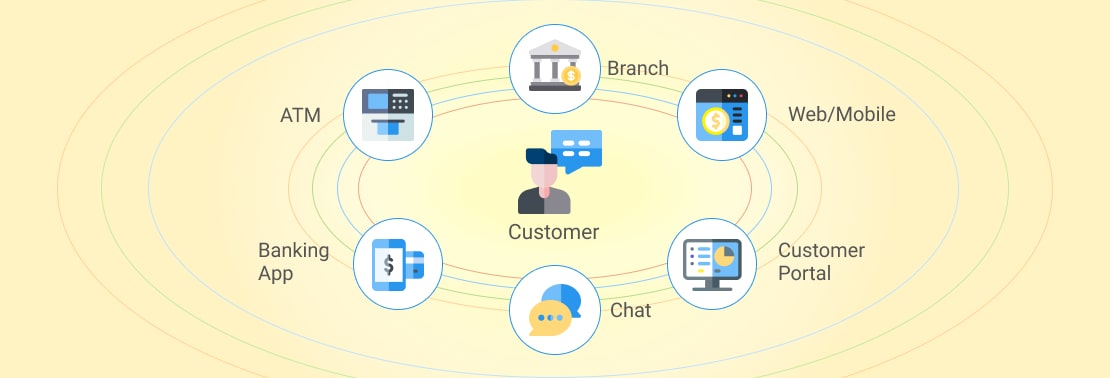

Omnichannel banking is a set of companies with a seamless expertise supplied by banks to their prospects through numerous on-line and offline channels. Financial institution prospects can carry out varied banking operations through the use of cellular banking apps, web sites, name facilities, financial institution branches, and different banking channels. They’re united into one digital ecosystem and synchronized amongst one another. This manner, prospects obtain an uninterrupted banking expertise anyplace and anytime.

For instance, a financial institution buyer can subject a credit score on an internet site, although end doc processing through a name middle with out the need to repeat all the info once more.

The adoption of the omnichannel strategy in service provision is changing into a widespread technique for a lot of companies, together with banking establishments. It represents an enhanced multi-channel service provision mannequin and consists of the next options:

- a client-centric view – when banks transfer from a bank-centric to a client-centric view. It signifies that they care concerning the expertise their prospects get hold of when interacting with the model, e.g. a well-build buyer journey map, understanding and optimization of buyer touchpoints, and different;

- interplay through a number of channels over transaction – when banks try to attach with their purchasers moderately than present automated companies, e.g. utilizing a customized strategy, prompt subject fixing, and so forth.;

- understanding the consumer need and want by way of analytics – when banks attempt to exceed expectations of their purchasers by anticipating their needs and desires with the assistance of detailed buyer information evaluation;

- reliance on programs of engagement – when banking establishments use FinTech devices designed for his or her purchasers, e.g. cellular apps constructed for purchasers or enterprise companions for efficient interplay with the banks;

- reliance on large information – large information is a supply of priceless insights on how you can enhance buyer companies in addition to streamline internal workflow for monetary establishments.

Key Advantages of Omnichannel Strategy in Banking

When adopting an omnichannel mannequin, banks get hold of an built-in infrastructure of all promotion channels. It permits switching between the channels with none disruption in buyer journeys, resulting in extra handy and personalised companies.

Let’s have a better take a look at the benefits that an omnichannel mannequin can supply to banks and their prospects.

- Quick downside decision

Omnichannel banking permits prospects to make use of totally different channels to unravel their ongoing banking issues. Due to this fact, they’ll change from digital instruments to face-to-face interplay with financial institution managers and again, resolving their points sooner. Furthermore, the interconnected system makes buyer points extra seen to totally different banking departments which helps to alternate the info or discover a specialist who can clear up the issue extra rapidly.

Omnichannel digital instruments usually embrace chatbots and digital assistants which assist resolve easy buyer inquiries with out the need to check with banking personnel. It reduces the operational prices allotted for customer support in addition to permits financial institution staff to raised give attention to extra advanced points.

Superior analytics is part of the omnichannel mannequin. The mannequin requires banks to deeply analyze the info they collect from their prospects, studying extra about their habits and preferences. In consequence, banks can create and supply the very best provides to their prospects and higher find out about every of their prospects’ wants.

With omnichannel digital instruments, banks can set up efficient communication with their purchasers and potential prospects by monitoring all of the touchpoints and utilizing varied communication channels.

Omnichannel banking includes robust safety instruments akin to multi-factor authentication, SMS verification, cellular banking app verification, and lots of others. This manner, banks can preserve their prospects’ private information protected whereas offering efficient companies.

Why Use Omnichannel in Retail Banking?

Digital transformation has closely influenced the banking sphere. Many banks have already established their on-line presence, transferring from a branch-centered offline strategy to a digital multi-channel technique.

Based on The Way forward for Non-public Banking in Europe report by McKinsey, in 2020 71% of European non-public banking purchasers most well-liked multi-channel interactions, with 25% of respondents able to embrace a completely digitally-enabled non-public banking journey with the choice of distant human help when it’s needed.

Though banks have change into extra accessible to their purchasers there are nonetheless many challenges to deal with. For instance, lack of connection between varied digital channels results in informational silos between financial institution departments, and interrupted buyer journeys make banking processes extra irritating and complex. Due to this fact, banks are frequently looking for new applied sciences and approaches to make their companies smoother and simpler to make use of.

Whereas long-standing banks are re-evaluating and upgrading their buyer approaches and repair provision choices, such large names as Apple, Amazon, Fb, and Google have gotten extra within the banking sector. The brand new rivals will convey the newest technological developments within the sphere and extra intently align banking companies with buyer expectations. Due to this fact, the prevailing banks need to act now and sooner embrace the omnichannel banking strategy to stay aggressive available in the market.

Constructing the Finest Omnichannel Banking Technique

For banks to show their digital infrastructure right into a complete distribution system, they have to give attention to the event of the next capabilities.

- Interconnected infrastructure

For establishing a profitable infrastructure of interconnected and aligned with one another promoting channels, banks must guarantee that they’ve developed a powerful multi-channel system to depend on. As soon as banks have this technique, the following step is to make sure a unified consumer report that tracks all interactions with the financial institution through all channels.

Superior analytics of the uncooked information gathered from their prospects helps banks to boost their buyer concentrating on. By analyzing buyer habits and normal habits patterns banks can optimize and enhance their lead technology by promoting the proper companies on the proper time. Apart from that, through the use of buyer analytics, banks can higher examine the transactional patterns and social media interactions and leverage this data for improved threat administration, making higher pricing choices, and others.

- Advertising personalization

Banks broadly undertake personalization advertising methods to boost their interplay with prospects and supply higher companies. They estimate the time purchasers spend on sure weblog matters, calculate the variety of clicks on the financial institution internet pages and use different strategies to carry out an in depth evaluation. With nice coordination throughout the promotion channels and detailed information evaluation, banks can construct simpler methods for providing extra personalised companies. e.g. utilizing direct channels like emails to evoke prospects’ curiosity in service and conclude the deal in private communication by cellphone.

- Outfitted and motivated salesforce

Other than utilizing digital instruments to raised meet prospects’ wants, banks additionally ought to think about the human facet of their omnichannel fashions. They need to make sure that buyer consciousness and curiosity triggered by analytics are backed up by a relationship supervisor. For this, banks have to coach their personnel how you can work with omnichannel programs and inspire them to supply top-notch companies.

Conclusion

International trade digitization urges banks to include digital instruments and programs of their work and undertake new approaches in customer support. Clients demand extra seamless and handy companies on the spot. That’s why many banks are already utilizing multi-channel fashions of their interplay with prospects.

Nevertheless, a multi-channel strategy isn’t a treatment for glorious customer support and there are nonetheless many challenges banking establishments need to deal with to extend their prospects’ satisfaction. One of many efficient methods is to transit from a multichannel to an omnichannel mannequin.

Omnichannel banking permits monetary establishments to combine their a number of promoting channels right into a coherent system that gives smoother customer support and permits banks to construct extra exact buyer methods. In consequence, banks enhance their prospects’ satisfaction with the companies, discover new methods to generate revenues and decrease operational prices.

![Beginner Python Path: A 3-Step Guide [Article]](https://newselfnewlife.com/wp-content/uploads/2025/08/DALL·E-2025-08-14-14.58.19-An-illustrated-widescreen-image-representing-Python-programming-with-a-colorful-and-modern-design.-A-coiled-snake-with-vibrant-blue-and-orange-colors-copy-360x180.jpg)

![How To Drive Better Response With Reddit Ads [Infographic]](https://newselfnewlife.com/wp-content/uploads/2025/08/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9yZWRkaXRfYWN0aW9uX2ludGVudDIucG5n.webp-120x86.webp)