How a lot do individuals spend on-line? In accordance with Statista, the general cost quantity in digital transactions is predicted to achieve $20.37 trillion in 2025.

The main motivators behind this development are comfort, ease of use, and various software program options that permit customers to make frictionless operations with one click on of a finger.

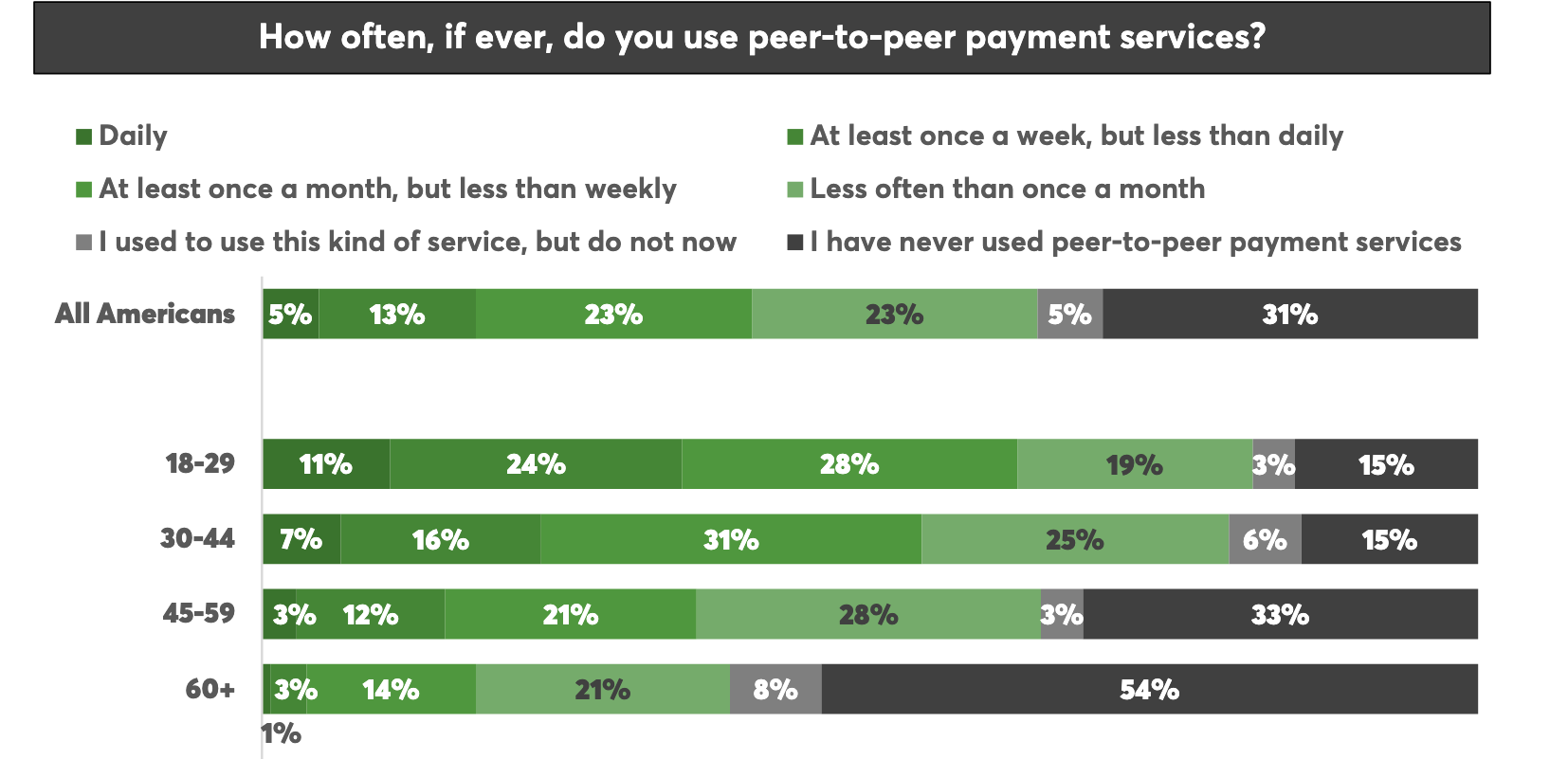

A big a part of all operations within the monetary sector is made up of P2P (peer-to-peer) funds. For instance, within the US greater than 50% of customers that devour monetary companies ship cash by way of P2P, whereas in Brazil this quantity is near 82%.

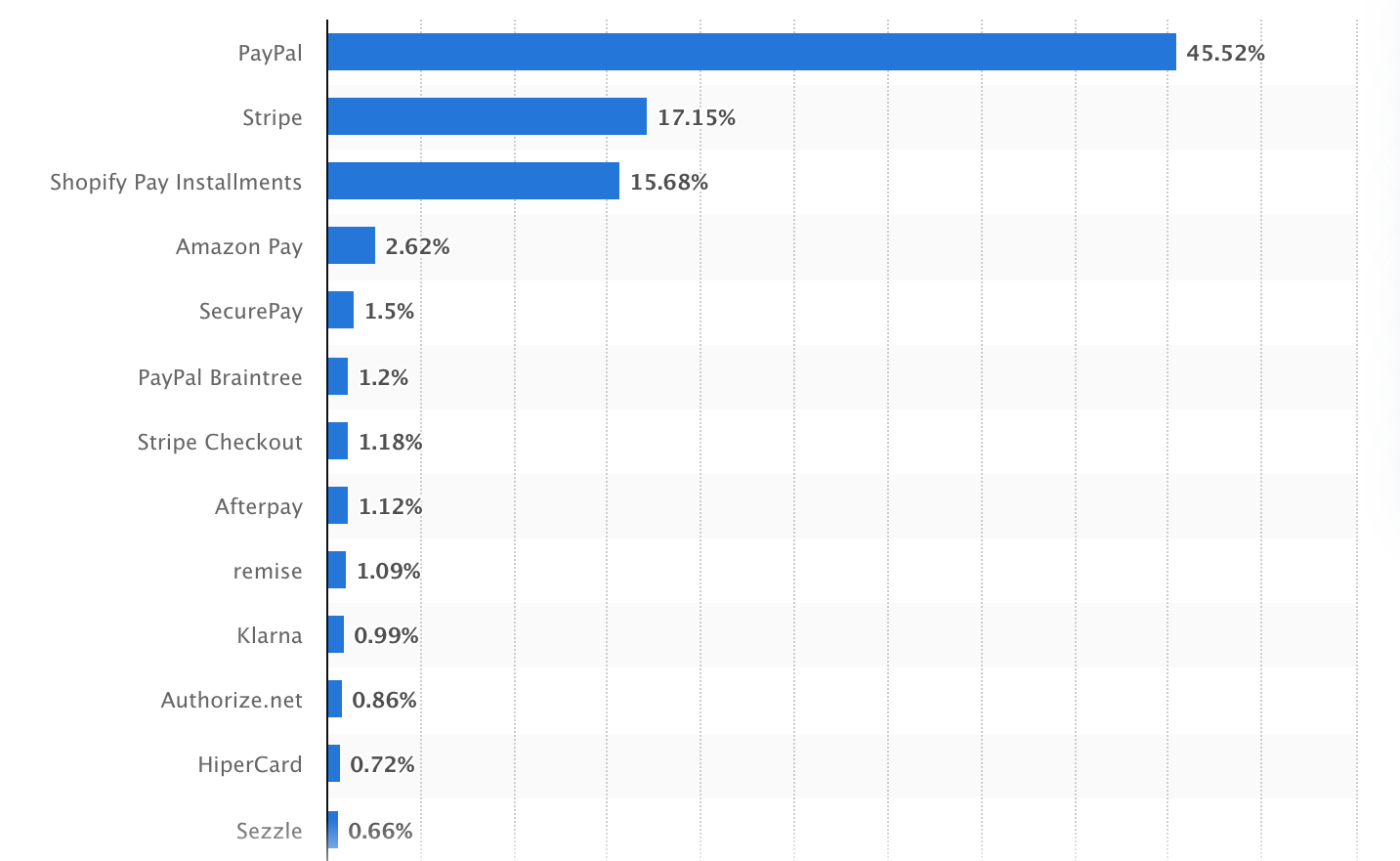

One other confirming issue is the recognition of such platforms as PayPal which is predicted to be the quickest-growing technique to pay all through the world.

Most used cost processing expertise, Statista

Digital pockets transactions in e-commerce, for instance, are anticipated to develop at a strong 15% per 12 months from 2023 to 2027.

Taking all of this into consideration, it’s grow to be clear that growing a P2P cost app seems to be a worthwhile enterprise with first rate monetization choices.

This information walks you thru every little thing it’s essential learn about customized cellular app growth to get a profitable P2P cost app.

What Is a Peer-to-Peer (P2P) Fee App?

A P2P cost utility is a software program instrument that permits individuals to switch cash to different individuals instantly with out banking intermediaries. P2P transfers, in flip, could discuss with splitting payments with associates or colleagues, paying lease, and even buying on the Web.

How Do P2P Fee Apps Work?

P2P cost purposes work by way of digital wallets, that are linked to a person’s checking account, debit card, or credit score cost card.

A person initiates the switch, the applying processes the cost and verifies the transaction earlier than the funds present up within the recipient’s account. Some P2P apps use blockchain, and others are based mostly on conventional banking infrastructure.

Statistics on using P2P cost programs amongst Individuals, Shopper Reviews

Sorts of P2P Fee Apps

Not all P2P cost apps are created equal—some pull cash instantly out of your financial institution, others act like digital wallets, and a few even use cryptocurrency.

In the event you plan to construct one, it is best to know the differing types so that you could be choose the best course.

Financial institution-Centric P2P Fee Apps: Immediate and Direct

As a result of these apps work instantly along with your financial institution, there’s no must load cash right into a separate pockets: while you ship money, it strikes straight from one checking account to a different, often in seconds.

Financial institution-centric apps are usually backed by giant monetary establishments, this fashion such purposes are good for individuals who desire a no-frills, easy cash switch with out further particulars getting in the way in which.

Standalone Digital Wallets: Extra Than Simply Cash Actions

As an alternative of transmitting cash straight out of your financial institution, these apps act as digital wallets the place you possibly can maintain your capital, make funds, and even do on-line buying.

Standalone digital wallets usually have numerous further perks: for instance, Venmo lets customers add emojis and make captions to funds, Money App gives a debit card, and PayPal is broadly used for on-line purchases and enterprise transactions.

Cell Wallets with P2P Options: All-in-One Service

Chances are you’ll have already got an concept about how nice a pockets app is to make contactless funds in-store at checkout.

However in addition they will let you ship cash proper out of your telephone to family and friends. As a result of these apps are built-in into the ecosystem of your gadget, you may as well take pleasure in added security options, akin to Face ID or fingerprint scanning.

Crypto-Based mostly Peer-to-Peer App: The Way forward for Cash

For individuals who desire digital currencies over traditional banking, Binance Pay, BitPay, and Coinbase Pockets make an ideal different.

Crypto transactions are thought of quicker and cheaper, particularly for worldwide cash transfers. In fact, they’ve some dangers, akin to worth volatility, however some purposes embed stablecoins, which maintain worth extra persistently.

By and huge, these purposes are good for crypto followers and any particular person excited by in search of out decentralized monetary options.

Cross-Border Fee Options: Constructed for Worldwide Transfers

The very benefit of cross-border cost apps is the comfort of transferring cash internationally with out paying ridiculous charges.

They allow you to maneuver money throughout borders at decrease prices than banks can and even maintain a number of currencies in your account.

Normally, these instruments are widespread amongst freelancers, companies, and frequent vacationers who cope with completely different currencies on a regular basis.

Benefits of Making Your Personal Peer-to-Peer Fee App

In the event you’ve ever thought of making your personal P2P cost app, you’re heading in the right direction.

Moderately than relying on companies like PayPal or Venmo that everybody can obtain from the app retailer, having your personal app means you get full autonomy over each a part of the applying.

To start with, while you make your personal cost instrument, you’re not caught with the restrictions of present platforms. Need on the spot transfers? Multi-currency assist? Perhaps even crypto funds?

You possibly can add no matter options that make sense in your customers. Not like third-party suppliers, the place you should work round their phrases, P2P app growth offers you the free will to create the expertise you need.

In fact, an vital facet is cash. Utilizing market software program usually means paying extra each time funds transfer. Which may not seem to be an excessive amount of at first, however these charges add up—particularly for companies directing a number of operations.

With your personal app, you totally regulate the pricing. You possibly can decrease charges to entice extra customers, supply premium components, add some unique means to monetize transactions, combine promoting, and even add cashback rewards—no matter works greatest in your viewers.

One other facet is safety. Whenever you personal the platform, you resolve how safe it’s. You possibly can combine encryption, biometric authentication, and fraud detection to show transactions are secure.

Plus, you keep in command of regulatory compliance, that means you possibly can assemble a reliable app that adheres to PCI DSS, GDPR, and KYC/AML with out leaning on third-party insurance policies.

Lastly comes scalability. You possibly can increase to new markets, assist new types of cost, and even combine AI-powered fraud detection.

The best way to Monetize a P2P Fee Service

Surprisingly sufficient, turning your P2P cellular cost utility right into a money-making machine could be simpler than you think about. Choices are monumental, and the ultimate alternative relies upon solely on which sort of elements to implement and below which scheme to place your venture.

Transaction Charges

The best means of bringing in earnings can be to cost transaction charges within the type of a small share or a flat price per switch.

As an illustration, Money App fees on the spot cost processing charges or in case you ship cash utilizing a bank card. Though this methodology offers you an everyday earnings, you shouldn’t demand unreasonable charges in order to not scare subscribers away.

Premium Options

Another choice is to promote a professional model or paid membership. Customers pays for quicker transfers, increased limits, or entry to premier extras, akin to monetary instruments or higher safety.

Premium options are fully price it, however on the identical time, they don’t oblige customers to something. They’ll simply stick with the free model or pay some cash to get some supplementary advantages.

Curiosity on Balances

In case your app lets customers retailer cash of their accounts, you possibly can earn it by investing their balances or teaming up with monetary establishments to supply curiosity on their funds.

PayPal does one thing related by utilizing the cash in customers’ accounts to earn curiosity, which may generate passive earnings for you whereas nonetheless allowing customers to utilize their funds when wanted.

In-App Promoting

In the event you’ve received an unchanging person base, you may make cash via in-app advertisements. This may very well be something from sponsored content material to associate choices.

The principle drawback right here is to not overflood your customers with too many promotions. You may additionally counsel an ad-free choice for a small price, which might let customers reject advertisements.

Partnering with Retailers

The fifth technique to monetize is by partnering with different companies and retailers. You possibly can take a small fee from companies with each transaction or give them a chance to promote or promote their companies inside your app.

Some apps (e.g., Money App) supply rewards within the type of cashback when shoppers store at particular retailers. All in all, it’s a win-win state of affairs, because it forces app utilization and brings in funds.

Cross-Border Funds

You can even cost charges for sending cash overseas in case your app permits for worldwide funds.

Cross-border often includes increased charges resulting from foreign money exchanges and extra rules, so it’s an effective way to earn a living by satisfying the wants of customers needing to ship cash to the opposite finish of the planet.

Knowledge Analytics & Insights

In the event you amass specific knowledge data (with person consent, after all), you possibly can present paid knowledge analytics for subscribers.

For instance, you possibly can promote insights into client buying patterns and spending tendencies, however cautiously and in a fashion that doesn’t violate person privateness.

Peer-to-Peer Lending

Through peer-to-peer lending, customers can provide and take cash from one another. From the monetization aspect, a money-lending app or the app with the lending performance can take small charges, reduce off the curiosity, or supply added monetary companies.

Important Options of Your P2P Fee App

Proudly owning a P2P cost app goes far above letting individuals ship and settle for funds. If you’d like your software program to get seen, we propose you add the next components:

- On the spot & Invulnerable Cash Transfers: The complete level of a profitable app is to transmit and settle for cash very quickly. Regardless of if customers pay associates, household, or companies, transactions ought to occur with no ready or as near it as potential.

- Multi-Fee Choices: Individuals by no means financial institution in the identical means, so your utility ought to supply a number of means to pay. Linking financial institution accounts, debit and bank cards, digital wallets, and even crypto will likely be nice on this path.

- Contact Syncing & QR Code Funds: No one needs to kind in lengthy account numbers when sending cash. This manner, your utility ought to auto-sync with the person’s contacts to permit them to ship funds with only a telephone quantity or e-mail. Incorporating QR code funds can add to comfort—customers can scan and pay, whether or not they’re splitting a invoice at dinner or paying a small enterprise.

- Transaction Historical past & Receipts: Customers want to observe their spending throughout the app; therefore, a crystal clear and arranged transaction historical past is what they require. Present particulars akin to the quantity paid, recipient, date, and standing—pending, accomplished, or failed.

- Fee Splitting & Request Options: Among the best options of cost apps is how simply they let one cut up payments. Be it lease, dinner, or a gaggle reward, customers ought to have the ability to cut up up funds and request cash from a number of individuals in only a few faucets.

- Notifications & Alerts: Customers ought to by no means need to guess if the transaction was accomplished. Push notifications and SMS/e-mail alerts will at all times hold them up-to-date on transactions, cost requests, or safety adjustments.

- Multi-Foreign money & Cross-Border Funds: If you wish to give your app the ability to achieve farther, present a number of currencies, worldwide transfers, integration with international trade companies, and reside conversion charges so customers know precisely how a lot they ship and obtain.

- Rewards, Cashback & Loyalty Applications: Just a little incentive goes a great distance. Totally different incentives, akin to cashback, reductions, or rewards for frequent customers, will persuade an increasing number of individuals to favor your app above others. One of many most interesting methods to differentiate your app out available in the market chaos is by displaying your customers appreciation.

The best way to Create a P2P Fee App

Constructing a P2P cost utility is definitely not about writing code however quite creating an acceptable expertise to please individuals. Proper from the characteristic choice to safety, quite a bit goes into making an utility profitable.

Assume Who You’re Developing Your On-line Fee App for

Earlier than plunging into cash switch app growth, step again and ask your self—who’s gonna use your app? Is it going to be for a buddy to separate payments with, or for small companies getting QuickPay or freelancers who receives a commission?

Realizing the individuals you’re reaching helps you form the best characteristic set and total path.

Plan the Compulsory Options

Now let’s go into options. On the minimal, your app should embrace cash transfers, a number of cost choices, and transaction historical past. If you wish to be completely different, add participating extras: QR code funds, invoice splitting, multi-currency assist, and cashback rewards. Assume of what is going to make sense in your customers and construct from there.

Work with a Dependable Improvement Companion

Let’s get actual—no P2P cost utility will ever get off the bottom with out correct experience. You want a robust tech basis, hermetic safety, and a killer person expertise.

That’s the reason it’ll make all of the distinction in case you associate with knowledgeable software program growth workforce to create a cash switch app. A superb associate for growth will enable you:

- Choose up the right expertise stack—both Flutter or React Native—to construct an superior utility.

- Implement adequate safety mechanisms: encryption, tokenization, and two-factor authentication.

- Create a user-oriented interface.

- Combine with cost gateways for flawless transactions.

Moderately than making an attempt to make every little thing by yourself, working with the best workforce ensures your app is made the best means from the start.

Check, Amend, and Check Once more

Deep testing of the applying should be carried out earlier than its launch. Useful testing confirms that every little thing works as demanded, safety testing finds vulnerabilities, and person testing supplies suggestions below lifelike situations.

The beta launch amongst a small group of customers will iron out the last-minute bugs earlier than the main launch. Skipping this step? Dangerous concept—it could result in safety issues or irritating customers.

Keep on the Proper Aspect of the Laws

Since you might be dealing with individuals’s cash, authorized compliance turns into an obligation. You’ll have to make it possible for your app conforms to such rules as PCI DSS for safe funds, GDPR for knowledge safety, and KYC/AML to forestall fraud.

Launch & Promote

When all is prepared, now’s the time to go reside. Don’t simply launch an app and hope issues go nicely; put it on the market. Use social media, influencers, and referral bonuses to onboard customers. A well-thought-out advertising and marketing program could make your app develop like loopy very quickly.

Hold Refining Based mostly on Person Solutions

Your work isn’t carried out as soon as the app is reside. Monitor person suggestions, watch how individuals use your app, and roll out updates to resolve points and make enhancements. The most effective apps consistently develop relying on what their supporters need.

Principal Roadblocks in Creating a P2P Fee App

That appears like an unbelievable concept for a P2P cost utility: quick cash transfers, simple monetization, and a rising person base.

Behind the scenes, nevertheless, it isn’t that straightforward. From safety and rules all the way down to guaranteeing that each transaction goes via, there are a number of obstacles concerned.

To start with, safety. Anytime cash is concerned, hackers and scammers are proper there in search of a means in. Due to this fact, your app must have all safety measures ever potential: encryption, two-factor authentication (2FA), and fraud detection.

If customers don’t really feel secure utilizing your app, they gained’t stick round. Meaning clear safety insurance policies, rip-off consciousness elements, and your private assure as an proprietor that cash is protected always.

Then comes regulatory compliance. Relying on the place your app operates, you’ll need to observe strict monetary rules, akin to PCI DSS (for unassailable card funds), KYC/AML (to confirm customers and management fraud), and GDPR (to safeguard person particulars).

Bear in mind compliance measures aren’t simply options—ignoring them may get you fined and even banned from sure areas. So adhering to those rules is a pure should.

Even with impeccable safety and compliance, it may be an issue to supply flawless cost processing.

Customers presume that cash shall be transferred on the spot in actual life; in actuality, it could nonetheless get delayed relying on how the banking programs are working, server downtimes, and community points, amongst others.

Your app additionally has to assist a slew of cost programs: financial institution transfers, debit playing cards, bank cards, e-wallets, digital belongings, and so forth. When the transactions fail or take longer, customers get pissed off and swap to different purposes.

The opposite large problem is gaining the customers’ belief: if persons are not 100% positive about your utility, they gained’t use it for one thing as vital as cash.

Unambiguous onboarding, lucid transaction coverage, and purchaser/vendor safety will go a great distance in gaining person confidence. On the identical time, a straightforward technique to dispute the transactions or request refunds at any time when one thing goes flawed makes fairly a distinction.

In the event you’re planning to assist cross-border operations, issues get much more problematic. Governing completely different currencies, trade charges, and worldwide transaction charges requires further planning.

Plus, some nations (e.g., the UK) have strict rules round digital funds, so that you’ll must seek the advice of with monetary companions who might help kind via the complexities.

Additionally, the extra customers use your utility, the upper the scalability subject you face. Customers will start dealing with gradual transactions, app freezing, and even failed funds in case your system just isn’t sturdy sufficient to carry excessive site visitors.

Investing in a cloud-based infrastructure and making your app extendable might help stop that from taking place forward of time.

Lastly, don’t neglect about buyer assist. Regardless of how nicely you make your app, issues generally go flawed—whether or not it’s a failed cost, an unauthorized cost, or a refund request.

Customers at all times want fast and useful assist. If they’ll’t get assist quick, they’re not going to stay round.

Widespread P2P Fee Apps You Can Use as a Reference

Even if there are already fairly just a few related options within the P2P cost market, you shouldn’t be afraid of competitors. Quite the opposite, present choices can be utilized as a reference, and based mostly on them, you possibly can create a cost app of your personal.

PayPal: The OG of On-line Funds

PayPal has been available on the market for fairly a while (nicely, since 1998), and it’s nonetheless probably the most trusted means for sending and receiving cash everywhere in the world, paying for on-line buying, freelancing, and making enterprise transactions.

What makes it nice?

- Works in tons of nations and helps many currencies.

- Enables you to sync financial institution accounts, bank cards, and PayPal balances for handy transfers.

- Offers purchaser and vendor safety, so that you don’t get scammed on purchases.

- Enterprise-friendly with invoicing, subscriptions, and cost processing.

Venmo: The Social Fee App

In the event you’ve ever seen somebody put up “simply paid for brunch” on their feed, likelihood is they’re utilizing Venmo. Though Venmo is owned by PayPal, this on-line digital banking platform differs from its mum or dad resulting from its social sharing characteristic.

Why individuals love Venmo:

- Enables you to add emojis, GIFs, and captions to funds.

- Affords on the spot transfers and direct deposit choices.

- Venmo debit card helps you to spend your steadiness anyplace.

- Works with on-line sellers, so you possibly can pay for any gadgets.

Money App: Extra Than Simply Cash Transfers

Money App from Block, Inc. (beforehand Sq.) does extra than simply funds. You possibly can ship cash, obtain cash, put money into shares, commerce Bitcoin, and even spend the steadiness by ordering a customized Money Card.

What’s nice about Money App?

- On the spot cash transfers with no hidden charges.

- An choice to purchase and promote Bitcoin proper within the app.

- Money Card linked to your Money App steadiness.

- Direct deposit characteristic so you may get your paycheck straight within the app.

Zelle: The Financial institution-Backed On the spot Switch Software

Zelle is somewhat completely different from different instruments—it’s constructed into most banking purposes and allows you to ship cash straight from one checking account to a different in seconds. No want for further wallets or accounts.

Why it’s a very good different:

- No further app is required in case your financial institution helps Zelle.

- No switch charges (yep, free on the spot transfers).

- Greater transaction limits in comparison with most P2P apps.

- Actually quick—cash lands within the recipient’s account inside minutes.

Google Pay & Apple Pay: Cell Wallets with P2P Bonuses

Google Pay and Apple Pay started as contactless cost programs, however in addition they permit individuals to ship cash to family and friends. In the event you’re deep in both the Apple or Google ecosystem, this performance is extraordinarily handy.

What makes them affordable?

- Faucet-to-pay at shops and on-line.

- No transaction charges for P2P transfers.

- Further safety with biometrics (Face ID, fingerprint scanning, and so forth.).

- Works with different Google and Apple companies.

Revolut: The Fintech Titan

However Revolut is far more than only a P2P cost app; it’s like a complete monetary hub the place you possibly can ship cash, trade currencies, commerce shares and crypto, and even arrange budgeting instruments.

Why individuals worth Revolut:

- Helps a number of currencies, nice for vacationers.

- On the spot transfers between Revolut customers.

- Enables you to commerce shares and cryptocurrencies.

- Has budgeting and analytics instruments to manage spending.

WeChat Pay & Alipay: China’s Excellent Apps

In China, WeChat Pay and Alipay dominate the P2P cost path. They’re built-in into on a regular basis life, from paying for groceries to hailing taxis and reserving flights—all with a easy QR code scan.

Why they monopolize in China:

- QR code funds for every little thing, from road sellers to luxurious shops.

- Deep integration with corporations, on-line buying, and ride-sharing apps.

- Helps invoice funds, insurance coverage, and funding choices.

- Protected and has AI-driven fraud prevention.

Finest Practices in Creating a P2P Fee App

As we talked about earlier, constructing a P2P cost app goes far above letting individuals ship funds.

With trade titans like Venmo, PayPal, and Money App already available on the market, your app must have one thing really unique to seize a share. So, what does it take to construct a P2P cost app that individuals really need to use?

To start with, safety should be impenetrable. Since your app will manipulate actual cash, it turns into a tempting goal for hackers and scammers. Be sure you have all means potential, akin to end-to-end encryption, two-factor authentication (2FA), and fraud detection.

Including biometric login choices, for instance, fingerprint or face recognition, may reinforce safety with out making it more durable for customers to log in. Word that if individuals don’t belief your software program, they’ll by no means use it.

Subsequent come transactions that should be quick and hassle-free. Nobody needs to attend round for his or her cash to undergo. Your app must be made for reside funds, with a robust backend that ensures flawless processing.

If individuals need to wrestle to make clear how you can ship cash, they’ll simply swap to a different app. Due to this fact, a clear, uncomplicated interface, instinctive navigation, and a fast transaction course of are non-negotiable.

In fact, abiding by the regulation can be a should. Many nations have uncompromising monetary rules, and failing to observe them can result in extreme fines, license revocation, and even long-term bans.

Customers also needs to have a simple channel to report scams, and a little bit of training on how you can spot fraud can go a great distance in conserving their accounts secure.

Regardless of how superior your app could also be, generally issues go flawed. In-app chat assist, AI chatbots, and a well-organized FAQ part will assist hold frustration ranges low and make customers really feel they don’t have anything to fret about.

In the event you really feel nervous about future development, keep in mind cloud-based infrastructure and optimized databases to maintain every little thing operating evenly, irrespective of how a lot site visitors your app will get. Planning for development from the beginning will prevent from main tech complications down the highway.

Earlier than launching, check every little thing—a number of instances. You’ll need to run useful assessments to verify all options work, safety assessments to detect vulnerabilities, and person assessments to shine the expertise.

A beta launch with a small group of customers may assist uncover any last-minute bugs or ache factors earlier than the total rollout. The extra you examine, the less unexpected points you’ll have when your app goes reside.

And at last, keep alert. The fintech trade strikes quick, and in case you don’t keep on tempo, you’ll lag behind. Common roll-out updates with recent options and efficiency modifications to stay aggressive.

Value of Creating a P2P Fee App

Constructing a P2P cost app can value anyplace from $50,000 to $500,000 or extra, relying on how advanced you need it to be. The extra options you add, like on the spot funds, fraud safety, or multi-currency assist, the upper the worth will go. On common:

- Primary MVP – $30,000–$50,000

- Characteristic-Wealthy App – $70,000–$150,000+

- Enterprise-Stage App – $200,000+

Whether or not you go for iOS, Android, or each platforms, and whether or not you rent freelancers, an in-house workforce, or outsource growth additionally impacts the ultimate value.

The event course of usually contains elaborating the design, constructing the backend, growing the cellular app options, and proving every little thing works appropriately with loads of testing.

Don’t neglect about hidden prices, akin to cloud internet hosting, cost gateway charges, and compliance consultations.

A great way to save cash is by beginning with an MVP (Minimal Viable Product) to check the app’s viability and add extra options over time if the platform comes out on high. Outsourcing growth and utilizing present cost APIs might help you slash prices with out sacrificing high quality.

Why Select Us for Your P2P Fee App Improvement?

Total, the SCAND workforce has over 20 years of expertise in software program growth. With deep experience in fintech and blockchain growth, we offer first-class experience to create secure, feature-packed, and handy P2P cost purposes.

Our workforce ensures adherence to all monetary rules and the implementation of superior applied sciences for flawless and high-performance software program instruments.

Whether or not you want a customized app from scratch or simply enhancements to an present system, we offer end-to-end growth companies adjusted to your plans and aspirations.

Regularly Requested Questions (FAQs)

What’s a peer-to-peer cellular cost app?

A P2P cost app lets individuals ship and obtain cash instantly—no intermediary wanted. P2P apps can be utilized to separate a invoice, pay a buddy again, or store on-line.

How do I begin growing P2P cost software program?

First, do your homework—analysis the market, determine what options customers search or lack, and specify what is going to make your app stand out. Subsequent, select a workforce up with skilled app builders to construct the app of your goals.

How a lot does it value to construct a customized P2P cost app?

It is dependent upon what you need your app to do. A easy model (MVP) may value round $30,000, whereas a completely loaded app with top-tier safety and further options may run over $200,000. By and huge, it is dependent upon integrations, compliance, and customized options.

How can I make my P2P cost differ from others?

There are tons of apps available on the market, so that you’ll want some unique attributes. It may be crypto transfers, AI-powered spending insights, or worldwide funds.

What are the principle obstacles in P2P cost app growth?

Constructing a cost app isn’t nearly coding—it’s about safety, compliance, and ensuring every little thing runs and not using a hitch. Fraud prevention, regulatory approvals, and integrating with completely different cost suppliers can get difficult. That’s why working with skilled fintech builders makes an enormous distinction.

How does a P2P cash switch app earn a living?

There are a bunch of means to monetize a cost app. You possibly can cost small transaction charges, supply premium options like on the spot transfers, create subscription plans, associate with retailers, and even add crypto buying and selling choices.

Do I would like to fret about compliance and rules?

Sure—fintech apps need to observe strict rules relating to PCI DSS, GDPR, and AML (Anti-Cash Laundering). Ignoring these can result in immense fines and even getting banned from working in sure areas.

How lengthy does it take to make a P2P cost instrument?

A primary app can take round 3-6 months, whereas a extra superior one with further options and AI fraud detection may take 12 months or extra. All of it is dependent upon the complexity, testing, compliance approvals, and person suggestions.

What cost strategies can I combine?

You possibly can assist all types of funds, no matter fits your shoppers—credit score/debit playing cards, financial institution transfers, digital wallets (Google Pay, Apple Pay), cryptocurrencies, and even QR code funds.

Why ought to I work with a growth associate as a substitute of constructing it myself?

Except you have got an in-house workforce of fintech specialists, outsourcing to a talented growth workforce is often the very best transfer. They’ll direct safety, compliance, UI/UX, and extendability so that you don’t need to stress over the technical aspect.