I’ve been an avid consumer of GXBank for the reason that first Malaysian digital banking platform received its begin final November.

A few of my favorite options that I at all times spotlight when recommending the platform is the limitless cashback of 1% when utilizing the GXBank debit card. One other factor is the three.00% p.a. every day rate of interest that they provide.

Properly, some vital updates shall be applied that can have an effect on these options.

Based on an e-mail from GXBank at the moment (September 6), there are two modifications that they are going to be doing because the digital financial institution turns 2 years outdated:

- The every day rate of interest shall be adjusted to 2.00% p.a. for his or her Important Accounts and Saving Pockets efficient October 1, 2024.

- They are going to be “revising” The GXCard’s limitless 1% cashback programme efficient November 6, 2024.

It’s not clear what they are going to be revising the cashback programme to, whether or not that be eradicating it solely or decreasing the proportion.

Additionally they didn’t touch upon whether or not there shall be modifications to the zero ATM withdrawal charges and 0 markups on international transactions that GX Card customers have been having fun with. Nevertheless, primarily based on what they’ve shared beforehand, the waive is ready to final till the top of this 12 months (December 31, 2024).

You’ll be able to’t please all of them

On their Fb announcement detailing these modifications, some netizens expressed dissatisfaction over the modifications.

Some identified that the brand new 2% p.a. rate of interest is decrease than many different choices out there, together with choices by conventional banks and digital banks alike.

As a comparability, AEON Financial institution is providing 3.88% p.a. revenue charges whereas Increase Financial institution is even providing as much as 4.0% rates of interest underneath particular situations.

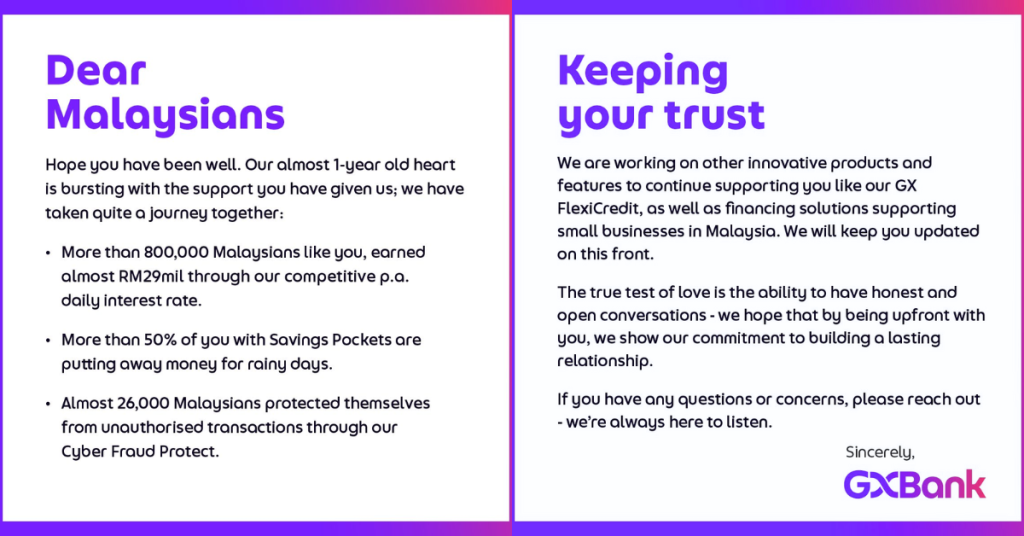

It’s a disgrace that GXBank is decreasing their rate of interest, however that doesn’t diminish what they’ve achieved up to now 12 months. GXBank shared that greater than 800,000 Malaysians have earned nearly RM29 million by their every day rates of interest.

Plus, it’s vital to notice that GXBank has at all times been clear that the GX Card’s 1% cashback on transactions with no cap would solely final till November 5, 2024.

Shifting ahead, GXBank shall be engaged on new merchandise equivalent to its GX Flexi Credit score, in addition to financing options to help small companies in Malaysia.

GX Flexi Credit score, which was introduced in August this 12 months, is basically a line of credit score designed to supply monetary flexibility to its clients.

The target is to let customers borrow with ease, paying curiosity solely on the funds used. It’s additionally designed to be fast and hassle-free, without having for paperwork and lengthy waits for approval.

This product will not be but launched but. As an alternative, GXBank is inviting Malaysians to hitch the waitlist on their web site.

As a continuing consumer of GXBank myself, I’m excited to see what’s subsequent for the digital financial institution, at the same time as these modifications roll out. Whereas the brand new 2.00% p.a. rate of interest is lower than ultimate, I imagine the brand new merchandise within the pipeline are nonetheless price keeping track of.

- Be taught extra about GXBank right here.

- Learn different articles we’ve written about digital banking right here.

Featured Picture Credit score: Vulcan Put up / GXBank

![The Most Visited Websites in the World [Infographic]](https://newselfnewlife.com/wp-content/uploads/2025/05/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS9tb3N0X3Zpc2l0ZWRfd2Vic2l0ZXMyLnBuZw.webp-120x86.webp)