Malaysian fintech startup Vircle introduced that it has secured its seed funding on October 31, 2023.

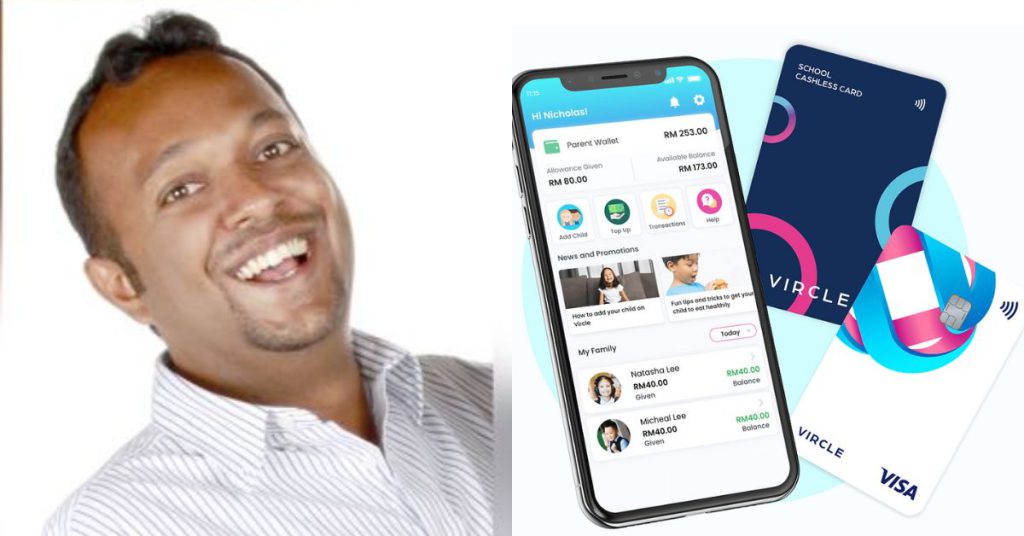

Vircle is a cashless fee answer that goals to show children secure and accountable spending in colleges in addition to out of colleges via its child-safe Visa pay as you go card.

In an interview with Vulcan Publish, Vircle CEO and founder Gokula Krishnan Subramaniam revealed that the full funding raised, inclusive of quantities closed and oversubscriptions which might be at present being finalised, is over the eight-digit mark.

This seed spherical is co-led by Kumpulan Modal Perdana (KMP) and Gobi Companions. KMP is a Malaysian tech-focused enterprise capital agency owned by the Ministry of Finance, beneath the purview of the Minister of Science, Know-how & Innovation (MOSTI).

In the meantime, Gobi Companions is an Asia-focused enterprise capital agency with headquarters in Kuala Lumpur. Its funding in Vircle is beneath its Gobi Dana Impak Ventures (GDIV) fund, which is part of Khazanah Nasional Berhad’s initiatives to assist native startups.

Previous to this seed spherical, Gokula shared that Vircle efficiently raised funding in 2021, led by 500 World’s 500 SEA III fund and 1337 Ventures, alongside angel buyers.

“That allowed us to develop our minimal viable product to hunt a powerful product-market match,” the CEO mentioned.

Publish-pandemic, Vircle noticed speedy progress in addition to sturdy product-market slot in its in-school section, which in flip inspired progress in its direct-to-consumer (D2C) product, the child-safe Visa card.

In accordance with this, the startup expedited its seed fundraising, Gokula shared, a course of that took nearly one yr from planning to closing.

On a mission to enhance monetary literacy

Based in 2019, Vircle was first designed to assist dad and mom nurture wholesome consuming and buying habits of their kids in colleges. That is achieved by working immediately with colleges to combine Vircle’s cashless college playing cards.

At present, the finance app has grown to do greater than that, with its Visa card enabling kids to practise accountable saving exterior of faculty. However its core mission continues to be to show kids monetary literacy abilities.

“We stay in the present day in a rustic the place over 40% of the grownup inhabitants don’t have any financial savings in any respect and we stay just about hand-to-mouth,” Gokula defined. “Nobody thinks sufficient concerning the significance of planning, considering twice about that impulse buy, or the necessity to save or make investments.”

He continued explaining that for a lot of adults, the primary “onerous lesson in cash” comes upon getting one’s first bank card and lacking out on month-to-month funds.

“No less than, for the older technology that was the case,” he mentioned. “However within the present on-line ecommerce world, our youth are being tempted to enter debt in lots of inventive methods, like BNPL, instalment, and many others., which all have hidden repercussions.”

As such, Vircle seeks to supply a secure and early introduction into the cashless world, permitting kids to be better-prepared to face such risks.

Recent funds for recent progress

In keeping with the press launch, Vircle’s recent funds will likely be used to develop its companies to public colleges nationwide because it continues its journey to financial institution a million Malaysian kids.

Vircle’s in-school answer has principally been utilized in worldwide colleges. So its introduction into public colleges will deliver what was predominantly an answer addressing the upper-middle class to the lots.

“Once we do public colleges, we wish to do it proper,” Gokula advised Vulcan Publish. “We perceive rattling nicely the complexity of doing colleges, one thing many don’t perceive.”

For one, the CEO believes Vircle is provided with the appropriate data to course of a excessive quantity of transactions in a brief interval. Furthermore, the group has additionally been working to acquire approvals with a number of states’ training departments.

“We’ll do it proper, scalable, and sustainable,” he mentioned.

On prime of the enlargement into public colleges, funds will even be utilised to develop Vircle’s group and develop its choices to satisfy kids’s well being, wellness, and well-being wants from a product perspective.

“We went from zero to 1 with a really small group. Now we develop, albeit surgically to satisfy a scaling part startup, bringing in additional senior people and focused competence to go from one to 100,” he mentioned. “It’s all about proper group, proper time.”

Security first

In its effort to repeatedly innovate, Vircle usually will get insights from dad and mom’ suggestions and their want lists. One among their largest issues is security, one thing that Vircle additionally takes severely.

Gokula defined, “We’re the one Visa pay as you go card on the market with inbuilt youngster secure controls and international service provider blocks. We do all of the analysis on high-risk retailers, improper classes and teams for teenagers, and we put this into our homegrown transaction processing engine which has helped us preserve children secure whereas giving dad and mom the peace of thoughts with over sight and controls.”

He identified that in Malaysia, minors can’t legally enter into contract. As such, the complete Vircle household banking is constructed with guardian consent built-in via its spending controls and household account administration.

“We don’t danger our youngsters’s future by making them join their very own e-wallet accounts with out recorded and verified guardian consent or oversight,” Gokula mentioned.

He believes that this one thing that some e-wallet suppliers enable in the present day, which finally ends up exposing younger teenagers as younger as 12 to hazard comparable to monetary scams. “Every little thing we do [is] to maintain children secure,” the Vircle CEO assured.

Greater and bolder enlargement targets forward

Within the greater image, Vircle’s mission is to financial institution a million Malaysian kids and a 3 million kids throughout Southeast Asia throughout the subsequent 5 years.

“We have now quite a lot of curiosity in two different Southeast Asian international locations, each we’re at present firming up our go-to-market,” Gokula mentioned.

Apart from that, Gokula talked about eager to go deeper into monetary studying and training financial savings, in addition to probably incorporating a digital account opening for unbanked children inside Vircle app itself.

“It’s going to be an thrilling 2024 for us,” Gokula mentioned.

- Study extra about Vircle right here.

- Learn different funding information we’ve written right here.

Featured Picture Credit score: KMP’s Yarham Yunus, Vircle founder & CEO Gokula Krishnan, and Gobi Co-founder Thomas G. Tsao

![X Shares Key Data on Holiday Season Planning [Infographic]](https://newselfnewlife.com/wp-content/uploads/2025/07/Z3M6Ly9kaXZlc2l0ZS1zdG9yYWdlL2RpdmVpbWFnZS94X2hvbGlkYXlfc2Vhc29uX2luZm9ncmFwaGljMi5wbmc.webp-120x86.webp)